ESG Operating models hold the key to ESG compliance

John Macpherson on ESG Risk

In my last article, I wrote about the need for an effective operating model in the handling and optimisation of data for Financial Services firms. But data is only one of several key trends amongst these firms that would benefit from a digital operating model. ESG has risen the ranks in importance, and the reporting of this has become imperative.

The Investment Association Engine Program, which I Chair, is designed to identify the most relevant pain points and key themes amongst Asset and Investment Management clients. We do this by searching out FinTech businesses that are already working on solutions to these issues. By partnering with these businesses, we can help our clients overcome their challenges and improve their operations.

While data has been an ever-present issue, ESG has risen to an equal standing of importance over the last couple of years. Different regulatory jurisdictions and expectations worldwide has left SME firms struggling to comply and implement in a new paradigm of environmental, sustainable and governance protocols.

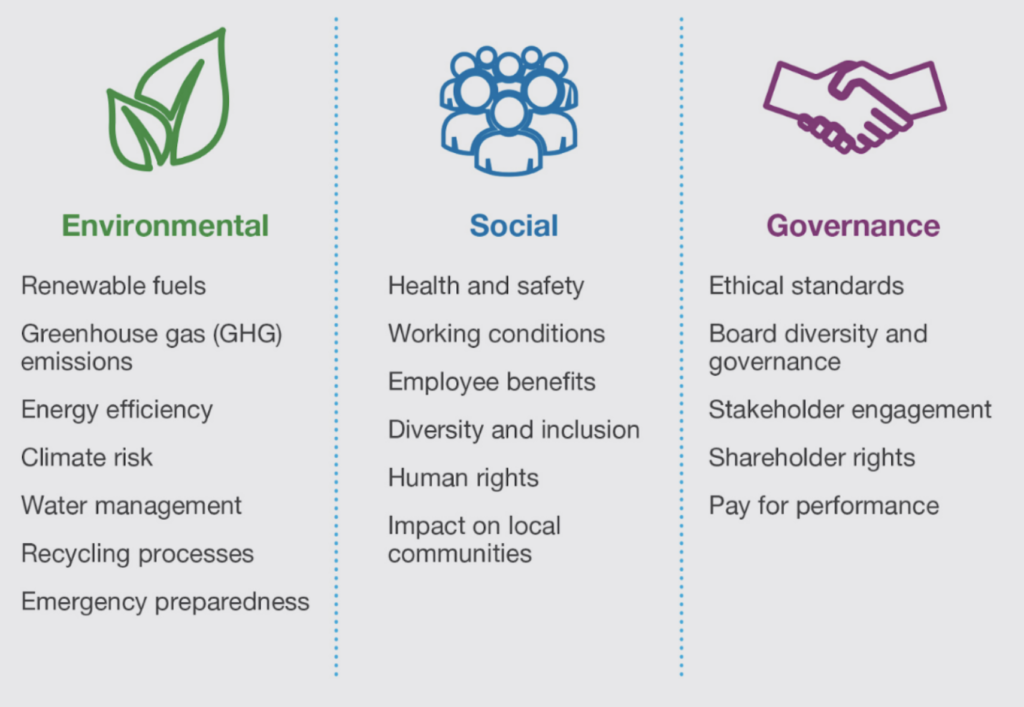

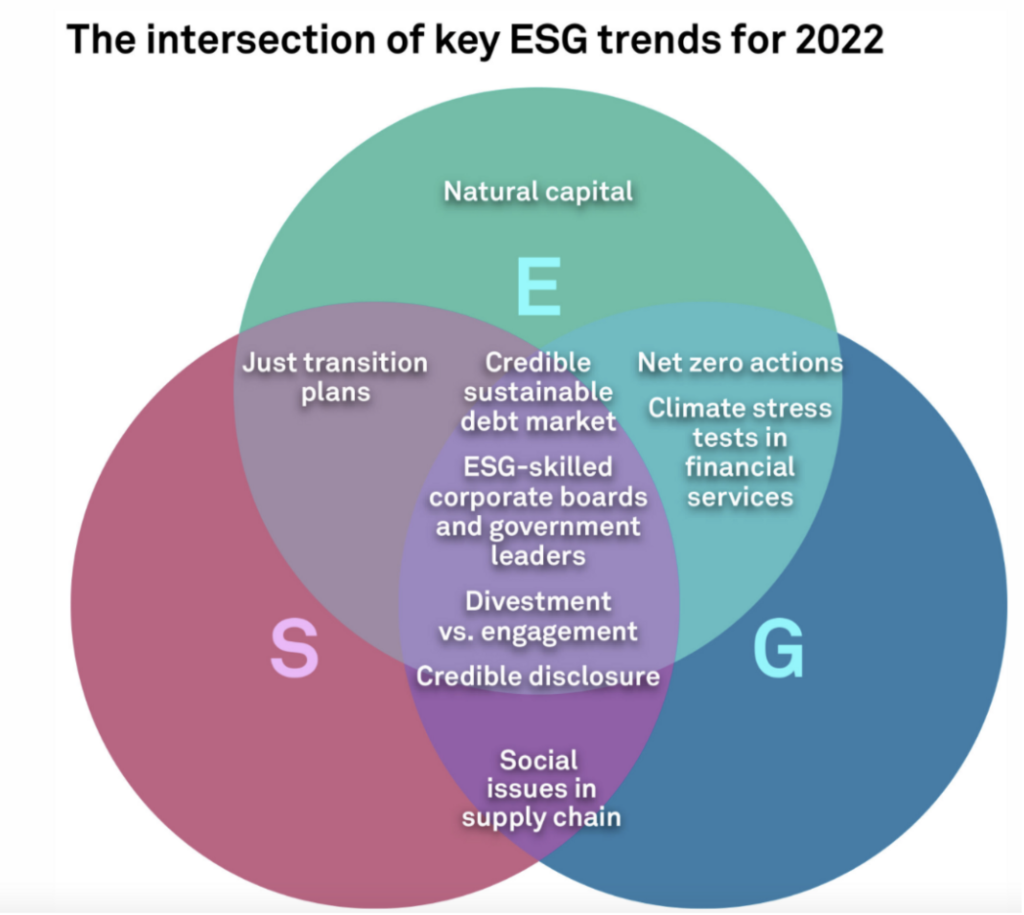

ESG risk is different to anything we have experienced before and does not fit into neat categories such as areas like operational risk. The depth and breadth of data and models required for firms to make informed strategic decisions varies widely based on the specific issue at hand (e.g., supply chain, reputation, climate change goals, etc.). Firms need to carefully consider their own position and objectives when determining how much analysis is needed.

According to S&P Global, sustainable debt issuance reached a record level in 2021, and is only expected to increase further in the coming years. With this growth comes increased scrutiny and a heightened concern of so-called ‘greenwashing’, where companies falsely claim to be environmentally friendly. To combat this, participants need to manage that growth in a way that combats rising concerns about ‘greenwashing’.

Investors, regulators and the public, in general, are keen to challenge large companies’ ESG goals and results. These challenges vary wildly, but the biggest seen on a regular basis range from human rights to social unrest and climate change. As organisations begin to decarbonise their operations, they face the initially overlooked challenge of creating a credible near-term plan that will enable them to reach their long-term sustainability goals.

Investor pressure on climate change has historically focussed on the Energy sector. Now central banks are trying to incorporate climate risk as a stress testing feature for all Financial Services firms.

Source: S&P Global

Operating models hold the key to ESG transition and compliance. Having an operating model for how each of the firm’s functions intersect with ESG, requires new processes, new data, and new reporting techniques. This needs to be pulled across the enterprise, so firms have a process that is substantiated.

Before firms worry about ESG scores from their market data providers, they would do well to look closely at their own operating model and framework. In this way, they can then pull in the data required from the marketplace and use it in anger.

Leading Point is a FinTech business I am proud to be supporting. Their operating model system, modellr™ describes how financial services businesses work, from the products and services offered, to the key processes, people, data, and technology used to deliver value to their customers. This digital representation of how the business works is crucial to show what areas ESG will impact and how the firm can adapt in the most effective way.

Rajen Madan, CEO at Leading Point:

“In many ways, the transition to ESG is exposing the acute gap in firms of not being able to have meaningful dialogue with the plethora of data they already have, and need, to further add to for ESG”.

modellr™ harvests a company’s existing data to create a living dashboard, whilst also digitising the change process and enabling quicker and smarter decision-making. Access to all the information, from internal and external sources, in real time is proving transformative for SME size businesses.

Thushan Kumaraswamy, Chief Solutions Officer at Leading Point:

“ESG is already one of the biggest drivers of transformation in financial services and is only going to get bigger. Firms need to identify the impact on their business, choose the right change option, execute the strategy, and measure the improvements. The mass of ESG frameworks adds to the confusion of what to report and how. Tools such as modellr™ bring clarity and purpose to the ESG imperative.”

While most firms will look to sustainability officers for guidance on matters around ESG, Leading Point are providing these officers, and less qualified team members, with the tools to make informed decisions now, and in the future. We have established exactly what these firms need to succeed – a digital operating model.

Words by John Macpherson — Board advisor at Leading Point and Chair of the Investment Association Engine

Leading Point have joined the SME Climate Commitment

Leading Point have joined the SME Climate Commitment

What is The SME Climate Hub?

The SME Climate Hub is a global collection of SMEs (small-medium enterprises) that have commited to halve emissions by 2030 and become net-zero by 2050. Included in this commitment is to report on progress yearly.

The SME Climate Hub is a network that supports SMEs on this vital net-zero journey.

Why we joined:

Leading Point is pleased to announce that we have joined the UN-backed SME Climate Commitment and formally committed to being net-zero in carbon emissions by 2030 (in advance of the minimum target of 2050).

We have joined the community of UK businesses tackling climate change through the SME Climate Hub. With their support, we will understand, track, and make strategic, impactful emission reductions to achieve our target of being a net-zero business by 2030.

Leading Point is committed to having a responsible, sustainable, and transparent operating model. We are excited to collaborate with other businesses on this scheme, and implement a business climate strategy using the tools created by Normative, CDP, Business for Social Responsibility (BSR™), and the University of Cambridge Institute for Sustainability Leadership (CISL).

We are proud to be taking the lead on climate action with the SME Climate Hub community and will be fully transparent with our progress.

Words from our Founding Partner and Chief Sustainability Officer, Thushan Kumaraswamy:

“Committing to a net-zero target is the right thing to do for the planet. It is also a bold statement for a growing startup. I want Leading Point to be at the forefront for fintechs who are making a climate change difference. As we grow, our impact on the environment naturally increases. I am excited to find the best ways to mitigate those impacts and share those findings with our peers.”

Words from our ESG Associate, Maria King:

“Climate change presents both potential risks and potential opportunities for businesses. Small to medium-sized enterprises (SMEs) account for 90% of business worldwide. However, only a small portion of these report on their emissions due to costs and complexity.”

Who we are:

Leading Point is a fintech specialising in digital operating models. We are revolutionising the way operating models are created and managed through our proprietary technology, modeller™, and expert services delivered by our team of specialists.

How To Sustainably Return To The Office & Incorporate ESG

How To Sustainably Return To The Office & Incorporate ESG

Freedom has engulfed the UK since the 19th of July, with restrictions and masks now being a choice, this means the penultimate move back to the office is looming, or already loomed for many of us. After a yearlong hiatus from the bustle of office life, it is time to up our ESG game. If you’re unfamiliar with ESG (Environmental, Social and Governance), there’s no better time than now to learn. More and more businesses are adopting ESG solutions in the hopes of bettering themselves, or simply, to keep up with the times. According to The Cone Communications Millennial Employee Study, 64% of millennial workers won’t take a job if the business does not have a strong corporate social responsibility (CSR) or ESG policy (1). Studies such as these reflect the traction ESG is generating, and why companies like us are so passionate about driving it.

Ways of working have fundamentally changed, and as companies navigate this, they have the chance to ensure that the environmental aspect of ESG is not only theoretical, but implemented into their everyday ways of working. SMEs are now using significantly more electricity than they need to, i.e., a small business uses an average of 15,000-25,000 kWh per year in the UK (2). To put those numbers into perspective, the average UK household consumes 3,731 kWh per year (3), and although an office accommodates more than a typical family home would, these figures are undeniably excessive.

Returning to the office after numerous COVID-19 lockdowns gives the feeling of a fresh start. We now have a chance to create a more carbon-neutral workplace that uses less energy, produces less waste, and benefits the overall welfare of staff. Cutting your office’s electricity consumption has endless benefits, from relieving the environment of greenhouse gasses and fossil fuels to reducing the costs associated with running your firm.

2021 will see a surge in policymakers taking action to manage and measure the climate crisis, but the key question is, how will you respond?

Improve your green credentials with these 3 simple steps:

1. Reduce your carbon footprint through your transport choices – take public transport, walk, or cycle. Even carpool if possible!

2. Support your local businesses – eat lunch near the office, go to local pubs after work. This reduces the energy exuded from delivery services and travel.

3. Lower your office's electricity consumption:

i) Open windows instead of using air conditioning.

ii) Minimise artificial lighting – during daylight, open blinds instead of using bulbs.

iii) Use energy-saving bulbs – switching to LEDs could save you 85% on your lighting costs according to EON (4).

iv) Install motion sensors to control lighting in certain rooms – ensures that lights are not left on needlessly.

v) Switch off computer workstations at the end of the day – reduces electricity consumption from appliances.

vi) Reduce paper wastage – print only when necessary.

vii) Consider micro-generation (small-scale production of heat and/or electricity from a low carbon source, i.e., solar panels).

viii) Book a commercial energy audit – quantify your firm's environmental impacts.

Keeping in line with the ever-changing rules, our team have slowly and recently migrated back to the office. ESG is a huge part of our service lines and overall ethos, therefore implanting green habits upon the return to the office was hugely important. ESG expert, Ziko Townsend, who has written several pieces on the importance of ESG, lets us in on how he has successfully, sustainably, returned to the office.

“I try to do the simple things. Walk as much as possible where I can, bring my own mugs for coffee and water, and try to recycle as much as I can at home and in the office.”

As you can see, there are tonnes of small ways, to make a big impact. We are in a unique situation in the work force right now that is giving us the opportunity to reset, change old habits and form new ways of everyday working. So, leave your pre-pandemic office habits in 2020, and use your new freedom to adopt some of the above suggestions upon your return to the office.

If you would like to learn more about Leading Point and how we help businesses manage change, you can reach us here.

By Nadyah Ibrahim - Marketing and Communications Executive

The Great Crypto-ESG Debate

The Great Crypto-ESG Debate

In my 13 years of finance, I’ve never quite encountered anything like this current trading environment. That’s taking into account a global financial crisis, a European debt crisis, a “flash crash”, and various other bits of absolute market turmoil and panic. Specialising in ESG investing has allowed me to strengthen my investment management craft in a way I have not been able to previously. It has been riveting to see the extent to which sustainability issues have affected the market’s views on different securities. As exciting as ESG considerations are, they seem relatively boring in comparison to cryptocurrency issues. As fate would have it, the two have recently become juxtaposed, and this provides an opportunity for some interesting views on where ESG and Cryptocurrency issues go from here.

So, what is cryptocurrency?

Cryptocurrency (as I understand it) is a decentralised vehicle for conducting various financial transactions, similar to the way money works, but in a much less conventional sense. What is untraditional about cryptocurrencies is that they operate through blockchain technology (BCT) rather than more orthodox mediums such as banks. This BCT is supposed to enable greater transparency and safety for the transacting parties. The creators of cryptocurrencies, also known as miners, use computational powers to solve complex algorithms and produce tokens. These tokens can then be bought, sold, and traded as needed.

ESG takes into account environmental, social and good governance factors in business decision making. At Leading Point, we have recently published our ESG Rationale and Action plan; read about them here.

The issue

One of the tenets of ESG is environmental sustainability. In recent years, there has been a monumental move in thinking towards climate change and the overall impact on human life. As a result, there has been a concurrent shift in businesses becoming more sustainable. This dynamic shift in thinking is unlikely to reverse.

One of the criticisms of the cryptocurrency mining process is that it tends to use a staggering amount of energy. For example, Cambridge University suggests that generating Bitcoin requires more power annually than powering Argentina. Higher electricity usage translates to higher CO2 production, which naturally is a big no-no in the ESG space. Of course, in a cruel twist of irony, there have been reports that the production of conventional forms of fiat currency (e.g. gold and copper) surpasses Bitcoin. Still, this has not slowed down the most recent criticism of cryptocurrencies. Many have argued that we cannot achieve greater efficiency in sustainability and increased cryptocurrency dominance at the same time.

The role that technology is playing in transforming the ESG market is well-documented. Meanwhile, BCT has seen higher usability across several sectors. So, the question is; where do we go from here in the great ESG vs Crypto debate?

There will be a sharper focus on the sustainability of cryptocurrency mining.

From its peak (at the time of writing), Bitcoin has fallen by more than 40% after Elon Musk (long time Bitcoin advocate and environmentalist) announced that Tesla would no longer be accepting Bitcoin as payment due to environmental concerns about its heavy energy use. Cardano, regarded as a much more sustainably mined cryptocurrency, has increased roughly 70% between May 2nd and May 16th as its executives have made moves to have Tesla replace Bitcoin with its offering. At Leading Point, we expect investors to continue to weigh sustainability and efficiency vs the popularity of various types of cryptocurrencies. As an asset class, cryptocurrencies will invariably come under greater regulatory scrutiny.

There will be increased volatility in the cryptocurrency market.

Investor discernment over sustainability will lead to higher volatility in cryptocurrency markets. This scrutiny adds to a trading dynamic that is already highly volatile.

ESG will continue to present moral and ethical dilemmas

If you’ve ever spoken to a very opinionated climate change activist, they may have been the type of person who wants to shut down fossil fuel production worldwide. While this would have immediate environmental benefits, there would be substantial human costs. No more fossil fuels would immediately put thousands out of work. At the same time, we’d also need massive infrastructural investment across the globe to ready ourselves thoroughly for new energy inputs. As one can imagine, there are numerous considerations.

As the world moves towards a more sustainable and responsible future, we view businesses as active participants rather than judging them as being “good or bad” in an ESG sense. At Leading Point, we have committed to using our expertise across many industries to help organisations address their stewardship needs. My most recent article talks on this in detail, exploring stewardship and ESG solutions, and why it will always matter, especially in 2021, read more here.

Summary

ESG vs Cryptocurrency is a debate that is growing in importance. We expect that this will reflect increased volatility and greater regulatory scrutiny.

How Startups Can Increase Employee Freedoms Without Losing Control

How Startups Can Increase Employee Freedoms Without Losing Control

Introduction from Leading Point:

We love collaboration here at Leading Point and we are lucky enough to have some great clients and partners that feel the same. We work with some similar like-minded start-ups that share some of the same challenges and adventures as us. Below is a brilliantly informative article by our friends at Spendesk, explaining how startups can successfully create a positive working environment for their employees through trust and freedom. At Leading Point, this is something we firmly embody. Forging strong, meaningful relations is how we deliver our services, and without a satisfied, confident team, this simply can't be done. If you're a startup, and increasing employee freedoms without losing control is something your company is in need of, don’t fret, this piece will provide great tips on how to apply some quick and easy changes to make team building better and brighter for everyone. Overall, we are delighted to be office neighbours with Spendesk, and are looking forward to some more collaborations in the future. Watch this space!

Words by Ellen Masterson:

Every employer wants their team to be happy, efficient, and effective. Most recognise that the vast majority make good decisions and don’t need to be micromanaged.

And yet, because of concerns about risk and compliance, many companies create hurdles that slow down their teams and take power away from actors.

As HBR explains, “executives have trouble resolving the tension between employee empowerment and operational discipline. This challenge is so difficult that it ties companies up in knots. Indeed, it has led to decades’ worth of management experiments, from matrix structures to self-managed teams.”

Today, we have bad solutions to legitimate concerns. The answer to a need for process security isn’t to restrict access - it’s to create more secure processes. And as we’ll see, that doesn’t have to be complex.

In this article, we’ll explore the reasons why companies struggle allowing freedom, and how a few simple shifts can make all the difference.

What prevents employee freedoms today?

Before getting to the positive actions all businesses can take, let’s start by identifying why employees may not have the freedom they need to excel.

Here, we’re talking about two kinds of freedom:

- Freedom to make decisions and shape their own work scope and projects;

- Freedom from excessive administrative and managerial pressure.

Together, these lead to more productive employees, a happier work environment, and faster growth.

In particular, we can look at two crucial causes.

A systemic lack of trust

This is fundamental. Many businesses simply aren’t structured to let team members think for themselves. Every decision must be scrutinized, and every action needs sign-off.

Of course, some micromanaging is always to be expected. And some actions really do need sign-off. But many don’t, and it’s vital to consider the cost of always putting the breaks on as team members push forward.

A few simple questions to ask:

- Are our employees free to do their best work?

- Are the rules we have in place helping, or hurting?

- Can we trust our teams to make the right decisions, without always second guessing?

As we’ll see, there are plenty of positive ways to remove hurdles without losing control over what really matters.

Closed-off systems and gatekeepers

Aside from the broad principle that employees should be free to make choices, there are common corporate practices that limit freedom - and not always for good reasons. Whether there’s limited institutional knowledge or a lack of trust, we make certain people responsible for processes, and lock everyone else out.

A few examples:

- Key business data is only accessible by executive leadership. New revenue, customer churn, and average deal size can all help employees make smarter decisions. But many simply don’t have access.

- Corporate credit cards belong to a few select managers. This makes it very hard for anyone else to spend company money, creates hurdles, and slows down business.

Today, we have ways to give employees more hands-on access to these processes without creating new risks or losing control. Let’s take a look at these now.

How to increase freedom while retaining control

We have what seem to be two conflicting objectives. But employee freedom and organisational freedom can certainly co-exist. Just follow these four principles.

1. Recognise trust as a core company value

If you want employees to feel free to do their best work, you obviously need to trust them to do so. What’s more, they need to know that they’re trusted to make decisions. This is empowering.

Which means that trust needs to be enshrined as a company value. Many startups are now taking the time to carefully craft their culture code - this is seen as vital to startup success. It’s also hugely important in the hiring process, and helps you keep employees around for longer.

So one way or another, trust needs to be in there. At Spendesk, for example, one of our core values is ownership. Each employee owns their scope and is empowered to make decisions. Which is another way of saying that the company trusts us.

2. Build systems that everyone can use

We mentioned above the trouble with having closed-off systems. This manifests itself in two main ways:

- Systems are so complex that only those with specific skills can use them;

- Most employees literally cannot access them - they lack the permissions or the tools to do so.

And of course, there is occasionally good reason for this. Average employees shouldn’t have access to the company bank account, for example. Which leads many finance teams to believe they need control over all spending. Or that only managers should have the right to spend company money. Neither of which are true.

Instead, you need systems that guide employees, set out limits and rules, and prevent them from making costly mistakes. Team members are free to make choices, just within certain parameters.

One example is replacing company credit cards and expense claims with more tailored spend management solutions. These let you set the rules per employee or team, create spending limits, and require managerial approval above certain thresholds.

So there you have full control. But employees have their own access - they don’t need to come begging for the corporate card - and finance teams don’t have to hold people’s hands throughout. The software guides them through each payment.

That was one just one example. But similar systems exist for HR and payroll, invoice processing, accounting, and a wide array of other corporate procedures.

3. Speak in plain language

Another simple error that many companies make is in communication. If you make policies harder to understand than they need to be, you actually reduce the likelihood that teams follow them. Which then leads to two outcomes:

- Reduced control, since people aren’t following the rules you create;

- Slower outcomes, because a manager or finance team member has to explain every transaction to employees one-to-one.

So the simple and impactful choice here is to ensure that internal policies and processes can be followed with no intervention. In practice, this means:

- No lengthy policy documents. The more you trust your team, the shorter you can make your travel and expense policy, for example.

- Keep jargon to a minimum. Documents should be easy to understand.

- Build policies into processes. Even better than cross-referencing policy documents is to have them actually built-into systems. Assume that people haven’t read the document, so have systems that guide them through the process and keep them within boundaries.

- Communicate clearly and repeat yourself. At a higher level, company values and expectations should be expressed openly and reiterated often.

Overall, don’t confuse freedom with a lack of rules. Employees need the freedom to make choices within clearly set boundaries. Knowing what’s expected and allowed is freeing.

4. Remove obvious administrative hurdles

One clear impediment to freedom is creating hurdles and hoops to jump through. If employees can’t work smoothly and independently - and are always catching up on paperwork - it’s hard to say that they’re operating freely.

But we can’t remove all admin for good. Instead, here are principles to make processes as painless as possible, while still maintaining compliance and control.

- Go paperless. The very act of filing a form by hand, only to digitize it later adds time and effort. Replace all paper-based systems with digital-first alternatives, and things will move faster and freer.

- Make processes and data easy to find. Employees should be able to answer their own questions and find solutions quickly. Otherwise, you’re forcing them to rely on others - usually HR and finance teams - which can quickly lead to interpersonal issues.

- Make approvals fast and efficient. Purchases will usually need a manager’s approval. As will other areas of compliance. Make this smoother with automated approval workflows, and with systems that track approvals asynchronously. In other words, it shouldn’t require an email chain to find out who approved a particular transaction. Build this into your systems.

We often think of admin as a necessary evil if we want to keep control and compliance. But you can have free-flowing, fast processes without creating unnecessary roadblocks along the way.

Conclusion

As mentioned above, it’s natural to micromanage and to seek control over company decisions. But it’s not good. You’ve hired team members for their skills and ingenuity, so why would you restrict their use of them?

Brian Carney and Isaac Getz offer this example of a liberated company’s manager: “When her team shares a problem or an opportunity with her, she will not offer a solution. Instead, she asks them to find their own—after ensuring that there isn’t something she’s doing that would get in the way.”

For some businesses, achieving liberated company status would be a tectonic shift. It’s a worthwhile project, but one that will take years and plenty of soul searching.

But we’ve seen examples above of precise, easy-to-implement changes that have profound effects. Start with a few of these, and gradually work towards becoming a company that puts employee trust on a par with corporate control.

After all, the two can naturally co-exist with no issue.

Author:

Ellen Masterson: Ellen Masterson is a UK and Ireland market expert at Spendesk, where she helps startups and scaleups establish simple yet robust spend management processes.

3 Reasons Why All Startups Should Embrace ESG

[et_pb_section fb_built="1" _builder_version="4.4.8" min_height="1084px" custom_margin="16px||-12px|||" custom_padding="0px||0px|||"][et_pb_row column_structure="2_3,1_3" _builder_version="3.25" custom_margin="-2px|auto||auto||" custom_padding="1px||3px|||"][et_pb_column type="2_3" _builder_version="3.25" custom_padding="|||" custom_padding__hover="|||"][et_pb_social_media_follow url_new_window="off" follow_button="on" _builder_version="4.4.8" text_orientation="left" module_alignment="left" min_height="14px" custom_margin="1px||5px|0px|false|false" custom_padding="0px|0px|0px|0px|false|false" border_radii="on|1px|1px|1px|1px"][et_pb_social_media_follow_network social_network="linkedin" url="https://uk.linkedin.com/company/leadingpoint" _builder_version="4.4.8" background_color="#007bb6" follow_button="on" url_new_window="off"]linkedin[/et_pb_social_media_follow_network][/et_pb_social_media_follow][et_pb_image src="https://leadingpointfm.com/wp-content/uploads/2020/09/start-ups.png" title_text="start ups" align_tablet="center" align_phone="" align_last_edited="on|desktop" admin_label="Image" _builder_version="4.4.8" locked="off"][/et_pb_image][/et_pb_column][et_pb_column type="1_3" _builder_version="3.25" custom_padding="|||" custom_padding__hover="|||"][/et_pb_column][/et_pb_row][et_pb_row column_structure="1_2,1_2" _builder_version="4.4.8"][et_pb_column type="1_2" _builder_version="4.4.8"][et_pb_text _builder_version="4.4.8" text_font="||||||||" text_font_size="14px" text_line_height="1.6em" header_font="||||||||" header_font_size="25px" width="100%" custom_margin="10px|-34px|-5px|||" custom_padding="16px|0px|5px|8px||" content__hover_enabled="off|desktop"]

Environmental, Social & Governance (ESG) issues are firmly on the board agendas of large, publicly-listed companies. 2021 marks the year in which VC-backed startups need to follow suit. What is the best way to achieve this change?

Some smaller companies have already made the move. A recent survey (1) of pre-seed and series A startups found that almost two thirds already have some ESG policies in place. Of those who didn’t, over half were now seriously considering them.

Startups can benefit from an ESG focus for three key reasons: a higher chance of investment, attracting better talent and risk mitigation.

Increased investment

Over the last five years there has been an explosion in VC funds focusing on startups in the ESG space. One such fund is DBL Partners. They are currently looking to raise $450m for their fourth fundt. Their mission involves investing in companies which provide capital returns while also enabling environmental and social benefits.

More recently, an increasing number of non-ESG focused VC firms are embedding ESG values into the companies they invest in. For example, Christine Tsai, CEO of 500 Startups, one of the most active global early stage venture capital firms whose “unicorn investments” include Credit Karma, Canva, Grab and Talkdesk, said that startups should implement ESG early on (2).

If startups want to stand out, they should embed ESG policies into their business model, principles and culture at the beginning rather than trying to “retro-fit” policies later under the pressure of investors or others.

Top talent attraction and retention

Startups with ESG values embedded in the business are more attractive to the best talent. This gives them a tangible competitive advantage.

Millennials currently make up 50% of the global workforce (3). A recent study (4) found that more than 40% said they had joined a firm because they performed better on sustainability. The same study showed that they are 70% more likely to stay longer if they feel the company has a strong sustainability plan.

However, relying on ESG policies and reporting (internally and externally) alone is not enough to benefit. Startups need to embrace a culture of openness at the core of their business. They must be honest to their stakeholders about their ESG weaknesses as well as their strengths. Only then will their ESG communications be authentic and have real impact on talent attraction and more importantly retention.

Risk mitigation

ESG policies can de-risk young companies as policy adoption becomes more difficult as they grow. A recent white paper (5) argued that startups are even more vulnerable to negative reputational impacts compared to more established firms, given their relatively small size and high growth characteristics.

For example, German fintech success story Wirecard shook the financial world earlier this year as it became clear that over $2bn was missing from their balance sheet (6). Also, in late 2019, it was reported that the CEO and founder of luggage startup AWAY, which had raised over $31 million, openly bullied and belittled her employees (7). This led to a media backlash against the company which greatly impacted their growth and market position.

With stronger governance policies and procedures, these scandals may have been avoidable. Startups which embed strong governance policies early on are much less likely to run into such issues.

How to integrate ESG into a VC-backed startup

It can be difficult for founders to decide which ESG policies to apply, which areas to focus on and how to communicate their outcomes authentically to stakeholders. Yet this is something which investors and top talent are increasingly looking for.

ESG action plans should follow a staged approach, with a roadmap assessed and realigned at each funding round:

- Map your current ESG strengths

Work out what you are already doing right, supported by resources such as the Sustainable Accounting Standards Board Materiality Map to work out which ESG policies and metrics are relevant for your industry. Also, map out the ecosystem of the different stakeholders your company interacts with, including customers, suppliers, regulators and employees.

- Develop your goals and measure your progress

Collect the relevant data to work out your current baseline and decide goals for the short, medium and long term, building a dashboard incorporating relevant Key Performance Indicators (KPIs) to track progress. ESG standards are complex and can need a multitude of different data points depending on the type of industry.

- Communicate your position

Regularly collect and communicate your ESG data to relevant stakeholders including investors, employees, regulators, consumers and the media. Publish your ESG successes and milestones on your social media channels and your recruitment page. You might also want to consider inviting in third party auditors to validate your ESG data and methods of collecting it, and look into external certification e.g B-corp status.

This brief overview may not answer all your questions.

If you would like to hear more about how we can help VCs and startups manage, improve and communicate their ESG impact please get in touch.

1. 500 Startups (2020) Survey results: The Impact of Covid-19 on the Early-Stage Investment Climate, https://survey.500.co/investor-survey-report-download/

2.Venture Capital Journal (Jun 2020) 500 Startups makes ESG top of mind going forward,https://www.venturecapitaljournal.com/500-startups-makes-esg-top-of-mind-going-forward/

3.KMPG (2017) Meet the millennials https://home.kpmg/content/dam/kpmg/uk/pdf/2017/04/Meet-the-Millennials-Secured.pdf

4. Fast Company (Feb 2019) Most millennials would take a pay cut to work at a environmentally responsible company,https://www.fastcompany.com/90306556/most-millennials-would-take-a-pay-cut-to-work-at-a-sustainable-company

5. CDC investment works & FMO Entrepreneurial Investment Bank (Jan 2020) Responsible venture capital Integrating environmental and social approaches in early-stage investing, https://assets.cdcgroup.com/wp-content/uploads/2020/01/16092500/Responsible-Venture-Capital.pdf

6. Markets Insider (Jun 2020) How $2 billion vanished from the balance sheet of Wirecard, according to a forensic financial expert, https://markets.businessinsider.com/news/stocks/wirecard-scandal-numbers-financial-forensic-expert-breakdown-2020-6-1029332810

7.The Verge (Dec 2019) Away’s founders sold a vision of travel and inclusion, but former employees say it masked a toxic work environment, https://www.theverge.com/2019/12/5/20995453/away-luggage-ceo-steph-korey-toxic-work-environment-travel-inclusion

[/et_pb_text][/et_pb_column][et_pb_column type="1_2" _builder_version="4.4.8"][et_pb_text disabled_on="on|on|off" _builder_version="4.4.8" min_height="15px" custom_margin="452px||133px|||" custom_padding="8px||0px|||"]

"Startups can benefit from an ESG focus for three key reasons: a higher chance of investment, attracting better talent and risk mitigation."

[/et_pb_text][et_pb_text disabled_on="on|on|off" _builder_version="4.4.8" min_height="15px" custom_margin="452px||133px|||" custom_padding="8px|||||"]

"If startups want to stand out, they should embed ESG policies into their business model, principles and culture at the beginning rather than trying to “retro-fit” policies later under the pressure of investors or others."

[/et_pb_text][et_pb_text disabled_on="on|on|off" _builder_version="4.4.8" min_height="15px" custom_margin="427px|||||" custom_padding="1px|||||"]

"ESG policies can de-risk young companies as policy adoption becomes more difficult as they grow."

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row column_structure="1_4,1_4,1_2" _builder_version="3.25"][et_pb_column type="1_4" _builder_version="3.25" custom_padding="|||" custom_padding__hover="|||"][et_pb_team_member name="Ben Bilefield " position="Leading Point" image_url="https://leadingpointfm.com/wp-content/uploads/2020/09/ben.png" linkedin_url="https://www.linkedin.com/in/alejandra-curtis-gutierrez-a851366a/" _builder_version="4.4.8" inline_fonts="Sarabun"]

Environmental Social & Governance (ESG) and Sustainable Investment

Client propositions and products in data-driven transformation in ESG and Sustainable Investing.

[/et_pb_team_member][/et_pb_column][et_pb_column type="1_4" _builder_version="4.4.8"][et_pb_team_member name="Dishang Patel" position="Start Ups and Scale Ups Advisor" image_url="https://leadingpointfm.com/wp-content/uploads/2020/03/Dishang-320x500-1.png" _builder_version="4.4.8" link_option_url="mailto:dishang@leadingpoint.io"]

Responsible for delivering digital FS businesses.

Transforming delivery models for the scale up market.

[/et_pb_team_member][/et_pb_column][et_pb_column type="1_2" _builder_version="4.4.8"][et_pb_text _builder_version="4.4.8" text_font_size="15px" width="100%" link_option_url="https://leadingpointfm.com/esg-the-future-pillars-of-investing/"]

Upcoming blogs:

This is the fourth in a series of blogs that will explore the ESG world: its growth, its potential opportunities and the constraints that are holding it back. We will explore the increasing importance of ESG and how it affects business leaders, investors, asset managers, regulatory actors and more.

Artificial Intelligence: the Solution to the ESG Data Gap? In the second part of our Environmental, Social and Governance (ESG) blog series, Anya explores the potential opportunities surrounding Artificial Intelligence and responsible investing.

Riding the ESG Regulatory Wave: In the third part of our Environmental, Social and Governance (ESG) blog series, Alejandra explores the implementation challenges of ESG regulations hitting EU Asset Managers and Financial Institutions.

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row column_structure="1_3,1_3,1_3" _builder_version="4.4.8"][et_pb_column type="1_3" _builder_version="4.4.8"][/et_pb_column][et_pb_column type="1_3" _builder_version="4.4.8"][et_pb_button button_url="https://leadingpointfm.com/wp-content/uploads/2020/09/Leading-Point-ESG-3-Reasons-why-all-startups-should-embrace-ESG-Sept-2020.pdf" button_text="Download our guide" button_alignment="center" _builder_version="4.4.8" custom_button="on" button_text_size="20px" button_text_color="#ffffff" button_bg_color="#0c71c3" button_font="|700||||on|||" button_icon="%%30%%" button_icon_color="#0c71c3" background_layout="dark" button_text_shadow_style="preset3"][/et_pb_button][/et_pb_column][et_pb_column type="1_3" _builder_version="4.4.8"][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built="1" module_class="txtwhite" _builder_version="3.22.3" background_color="#23408f" custom_padding="||62px|||" locked="off"][et_pb_row _builder_version="4.4.8"][et_pb_column type="4_4" _builder_version="4.4.8"][et_pb_text _builder_version="4.4.8" text_text_color="#ffffff" text_font_size="15px" header_text_color="#ffffff"]

How Leading Point can help

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row column_structure="1_3,1_3,1_3" _builder_version="4.4.8"][et_pb_column type="1_3" _builder_version="4.4.8"][et_pb_blurb_extended title="Bringing clarity to your company’s ESG data" use_icon="on" font_icon="%%384%%" icon_color="#ffffff" use_icon_font_size="on" icon_font_size="39px" icon_hover_color="#17a826" style_icon="on" icon_shape="use_circle" use_shape_border="on" shape_border_color="#ffffff" shape_border_hover_color="#17a826" title_hover_color="#17a826" _builder_version="4.4.8" header_text_align="left" header_text_color="#ffffff" header_font_size="17px" read_more_icon="%%20%%" text_orientation="center" custom_margin="5px|1px|5px|1px|false|false" custom_padding="0px|0px|0px|0px|false|false" animation_style="fade" locked="off"]

By using our cloud-based data visualisation platform to bring together relevant metrics, we help organisations gain a standardised view and improve your ESG reporting and portfolio performance. Our live ESG dashboard can be used to scenario plan, map out ESG strategy and tell the ESG story to stakeholders.

[/et_pb_blurb_extended][/et_pb_column][et_pb_column type="1_3" _builder_version="4.4.8"][et_pb_blurb_extended title="Accelerating the collection of ESG metrics using AI" use_icon="on" font_icon="%%389%%" icon_color="#ffffff" use_icon_font_size="on" icon_font_size="39px" icon_hover_color="#17a826" style_icon="on" icon_shape="use_circle" use_shape_border="on" shape_border_color="#ffffff" shape_border_hover_color="#17a826" title_hover_color="#17a826" _builder_version="4.4.8" header_text_align="left" header_text_color="#ffffff" header_font_size="17px" read_more_icon="%%20%%" text_orientation="center" custom_margin="5px|1px|5px|1px|false|false" custom_padding="0px|0px|0px|0px|false|false" animation_style="fade" locked="off"]

AI helps with the process of ingesting, analysing and distributing data as well as offering predictive abilities and assessing trends in the ESG space. Leading Point is helping our AI startup partnerships adapt their technology to pursue this new opportunity, implementing these solutions into investment firms and supporting them with the use of the technology and data management.

[/et_pb_blurb_extended][/et_pb_column][et_pb_column type="1_3" _builder_version="4.4.8"][et_pb_blurb_extended title="Assisting companies to implement upcoming EU ESG regulations" use_icon="on" font_icon="%%392%%" icon_color="#ffffff" use_icon_font_size="on" icon_font_size="39px" icon_hover_color="#17a826" style_icon="on" icon_shape="use_circle" use_shape_border="on" shape_border_color="#ffffff" shape_border_hover_color="#17a826" title_hover_color="#17a826" _builder_version="4.4.8" header_text_align="left" header_text_color="#ffffff" header_font_size="17px" read_more_icon="%%20%%" text_orientation="center" custom_margin="5px|1px|5px|1px|false|false" custom_padding="0px|0px|0px|0px|false|false" animation_style="fade" locked="off"]

Implementing ESG regulations and providing operational support to improve ESG metrics for banks and other financial institutions. Ensuring compliance by benchmarking and disclosing ESG information, in-depth data collection to satisfy corporate reporting requirements, conducting appropriate investment and risk management decisions, and to make disclosures to clients and fund investors.

[/et_pb_blurb_extended][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built="1" _builder_version="3.22.3" animation_style="fade" locked="off"][et_pb_row _builder_version="3.25"][et_pb_column type="4_4" _builder_version="3.25" custom_padding="|||" custom_padding__hover="|||"][et_pb_text admin_label="Contact Us" module_class="txtblue" _builder_version="3.27.4" text_font="||||||||" link_font="||||||||" ul_font="||||||||" text_orientation="center"]

Contact Us

[/et_pb_text][et_pb_text admin_label="Form" _builder_version="3.27.4"][formidable id=2][/et_pb_text][et_pb_code admin_label="Social media icons" module_class="form" _builder_version="3.19.4" custom_margin="0px||0px" custom_padding="0px||0px"]

- Connect

[/et_pb_code][/et_pb_column][/et_pb_row][/et_pb_section]

Riding the ESG Regulatory Wave

[et_pb_section fb_built="1" _builder_version="4.4.8" min_height="1084px" custom_margin="16px||-12px|||" custom_padding="0px||0px|||"][et_pb_row column_structure="2_3,1_3" _builder_version="3.25" custom_margin="-2px|auto||auto||" custom_padding="1px||3px|||"][et_pb_column type="2_3" _builder_version="3.25" custom_padding="|||" custom_padding__hover="|||"][et_pb_social_media_follow url_new_window="off" follow_button="on" _builder_version="4.4.8" text_orientation="left" module_alignment="left" min_height="14px" custom_margin="1px||5px|0px|false|false" custom_padding="0px|0px|0px|0px|false|false" border_radii="on|1px|1px|1px|1px"][et_pb_social_media_follow_network social_network="linkedin" url="https://uk.linkedin.com/company/leadingpoint" _builder_version="4.4.8" background_color="#007bb6" follow_button="on" url_new_window="off"]linkedin[/et_pb_social_media_follow_network][/et_pb_social_media_follow][et_pb_image src="https://leadingpointfm.com/wp-content/uploads/2020/09/wave-again.jpg" title_text="wave again" align_tablet="center" align_phone="" align_last_edited="on|desktop" admin_label="Image" _builder_version="4.4.8" locked="off"][/et_pb_image][/et_pb_column][et_pb_column type="1_3" _builder_version="3.25" custom_padding="|||" custom_padding__hover="|||"][/et_pb_column][/et_pb_row][et_pb_row column_structure="1_2,1_2" _builder_version="4.4.8"][et_pb_column type="1_2" _builder_version="4.4.8"][et_pb_text _builder_version="4.4.8" text_font="||||||||" text_font_size="14px" text_line_height="1.6em" header_font="||||||||" header_font_size="25px" width="100%" custom_margin="10px|-34px|-5px|||" custom_padding="16px|0px|5px|8px||" content__hover_enabled="off|desktop"]

Riding the ESG Regulatory Wave

In the third part of our Environmental, Social and Governance (ESG) blog series, Alejandra explores the implementation challenges of ESG regulations hitting EU Asset Managers and Financial Institutions.

A new brand of Regulation

Whilst the world is still recovering from the effects of COVID-19, and adapting to the issues uncovered as a result of the Black Lives Matter movement, adopting sustainable practices and timely adherence to ESG regulations is pivotal in safeguarding a company’s long-term success.

Widely recognised as being more than a fad or a feel-good exercise, it is clear that creating stronger ESG alignment correlates with higher equity returns.* Compliance with ESG regulations will create monumental changes to the financial services industry and it will take well-rounded experience in regulatory transition to ensure seamless adherence and minimal disruption to operations.

Similar to the Know Your Client (KYC) and Anti Financial Crime (AFC) regulation landscape of five years ago, ESG regulation implementation will require heavy lifting from the advisory and consulting sectors. Compounded with this, firms need a commitment to transition and adjust investment principles and processes in order to achieve these ambitious goals.

This influx of new rules reflects the regulators attempts to catch up with longstanding investor demand.** As a result of these optional and mandatory principles, businesses are understanding the importance of having well-governed and socially-responsible practices in place, making it the optimal time for financial institutions to start planning for ESG rules implementation.

Upcoming EU ESG Regulation Examples

- MiFID II Amendments (in force Q1 2020) Advisers will need to be more proactive with customers in relation to ESG considerations by asking them about their preferences

- The Taxonomy Regulation (in force July 2020) Sets out a common classification system to determine which economic activities and investments can be treated as “environmentally sustainable”

- Benchmarks Regulation Has been amended to include two new benchmarks to help increase transparency and avoid greenwashing

4. Stress Testing Rules for Banks Tools and mechanisms to integrate ESG factors into the EU prudential framework, banks’ business strategies, investment policies and risk management processesIn the last three years, ESG regulations grew by 158% in the UK, and by 145% in the US and Canada.***

The most regulated topics are business ethics and climate change in financial services, energy use and consumer rights in the US utilities, and product and service safety in healthcare and pharmaceuticals.

These regulations will affect many areas significant to asset managers, from corporate governance to process and product considerations. Implementing these changes effectively in order to gain a competitive advantage over their peers and avoiding the burden of non-compliance will mean drawing up consistent definitions, identifying the data points needed to set comparable targets, monitoring investments and reporting to regulators. Additionally, they will have to consider their role in the design, delivery and sale of financial services and products.

Data, Benchmarking and Disclosure

When it comes to benchmarking and disclosing data it is important to highlight the difference between ‘sustainability’ and ‘ESG’. Specifically with ESG information, the devil is in the detail. Asset managers must perform this in-depth data collection to satisfy their own corporate reporting requirements, to conduct appropriate investment and risk management decisions, and to make disclosures to clients and fund investors.

Because asset managers produce, distribute and ingest financial and non-financial ESG data, these regulations can bring competitive advantage and clarity to those who implement them effectively.

A typical asset manager will have to ingest endless subsets of relevant ESG considerations from various asset classes, industries and geographies all of which depend on differing underlying data in order to reach informed and accurate decisions. The major challenge is being able to determine the data points required to set comparable targets, monitor investments, and measure and compare performance across sectors, industries, and national or regional borders.

Implementation Insights

A proactive approach is essential as it enables firms to gain an early understanding of the changes needed to their operations and position them as credible, trusted partners with regulators.

Once an organisation has established its guiding vision and strategy for implementing investment principles, the real work begins. Updates to compliance, risk management, product development, data management, sales and reporting processes all need to take place and have to be coordinated across business units and functions to ensure consistency and traceability.

Analysis and assembly of regulations, standards and good practices, clear and up-to -date management views and evaluation of peer approaches all have to be part of a holistic regulatory implementation approach.

Whilst trying to predict the future and see the outcomes of implementing these future-facing requirements, it is important to remember the importance of flexibility and adaptability. The transition has to be well-managed and sustainable to be maintained. It is also important to incorporate lessons learnt from previous regulatory implementations. The organisations who will come out the strongest will be those who take the time to invest and begin with a good understanding of the changes in the operational environment and internal capabilities required.

** https://www.unpri.org/signatories/signatory-resources/signatory-directory

*** https://www.datamaran.com/global-insights-report

[/et_pb_text][/et_pb_column][et_pb_column type="1_2" _builder_version="4.4.8"][et_pb_text disabled_on="on|on|off" _builder_version="4.4.8" min_height="15px" custom_margin="452px||133px|||" custom_padding="8px|||||"]

"Compliance with ESG regulations will create monumental changes to the financial services industry and it will take well-rounded experience in regulatory transition to ensure seamless adherence and minimal disruption to operations."

[/et_pb_text][et_pb_text disabled_on="on|on|off" _builder_version="4.4.8" min_height="15px" custom_margin="452px||133px|||" custom_padding="8px|||||"]

"Because asset managers produce, distribute and ingest financial and non-financial ESG data, these regulations can bring competitive advantage and clarity to those who implement them effectively."

[/et_pb_text][et_pb_text disabled_on="on|on|off" _builder_version="4.4.8" min_height="15px" custom_margin="427px|||||" custom_padding="1px|||||"]

"Similar to the Know Your Client and Anti Financial Crime regulation landscape of five years ago, ESG regulation implementation will require heavy lifting from the advisory and consulting sectors."

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row column_structure="1_4,1_4,1_2" _builder_version="3.25"][et_pb_column type="1_4" _builder_version="3.25" custom_padding="|||" custom_padding__hover="|||"][et_pb_team_member name="Alejandra Curtis " position="Leading Point" image_url="https://leadingpointfm.com/wp-content/uploads/2020/09/alejandra-1.png" linkedin_url="https://www.linkedin.com/in/alejandra-curtis-gutierrez-a851366a/" _builder_version="4.4.8" inline_fonts="Sarabun"]

Environmental Social & Governance (ESG) and Sustainable Investment

Client propositions and products in data-driven transformation in ESG and Sustainable Investing.

[/et_pb_team_member][/et_pb_column][et_pb_column type="1_4" _builder_version="4.4.8"][et_pb_team_member name="Rajen Madan" position="Founder and CEO" image_url="https://leadingpointfm.com/wp-content/uploads/2020/09/rajen.png" _builder_version="4.4.8" link_option_url="mailto:thush@leadingpoint.io"]

Responsible for delivering digital FS businesses.

Change leader with over 20 years’ experience in helping financial markets with their toughest business challenges.

[/et_pb_team_member][/et_pb_column][et_pb_column type="1_2" _builder_version="4.4.8"][et_pb_text _builder_version="4.4.8" text_font_size="15px" width="100%" link_option_url="https://leadingpointfm.com/esg-the-future-pillars-of-investing/"]

Upcoming blogs:

This is the third in a series of blogs that will explore the ESG world: its growth, its potential opportunities and the constraints that are holding it back. We will explore the increasing importance of ESG and how it affects business leaders, investors, asset managers, regulatory actors and more.

Artificial Intelligence: the Solution to the ESG Data Gap? In the second part of our Environmental, Social and Governance (ESG) blog series, Anya explores the potential opportunities surrounding Artificial Intelligence and responsible investing.

Is it time for VCs to take ESG seriously? In the fourth part of our Environmental, Social and Governance (ESG) blog series, Ben explores the current research on why startups should start implementing and communicating ESG policies into their business.

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row column_structure="1_3,1_3,1_3" _builder_version="4.4.8"][et_pb_column type="1_3" _builder_version="4.4.8"][/et_pb_column][et_pb_column type="1_3" _builder_version="4.4.8"][et_pb_button button_url="https://leadingpointfm.com/wp-content/uploads/2020/09/Leading-Point-ESG-Riding-the-Regulatory-Wave-Aug-2020-1.pdf" button_text="Download our guide" button_alignment="center" _builder_version="4.4.8" custom_button="on" button_text_size="20px" button_text_color="#ffffff" button_bg_color="#0c71c3" button_font="|700||||on|||" button_icon="%%30%%" button_icon_color="#0c71c3" background_layout="dark" button_text_shadow_style="preset3"][/et_pb_button][/et_pb_column][et_pb_column type="1_3" _builder_version="4.4.8"][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built="1" module_class="txtwhite" _builder_version="3.22.3" background_color="#23408f" custom_padding="||62px|||" locked="off"][et_pb_row _builder_version="4.4.8"][et_pb_column type="4_4" _builder_version="4.4.8"][et_pb_text _builder_version="4.4.8" text_text_color="#ffffff" text_font_size="15px" header_text_color="#ffffff"]

How Leading Point can help

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row column_structure="1_3,1_3,1_3" _builder_version="4.4.8"][et_pb_column type="1_3" _builder_version="4.4.8"][et_pb_blurb_extended title="Bringing clarity to your company’s ESG data" use_icon="on" font_icon="%%384%%" icon_color="#ffffff" use_icon_font_size="on" icon_font_size="39px" icon_hover_color="#17a826" style_icon="on" icon_shape="use_circle" use_shape_border="on" shape_border_color="#ffffff" shape_border_hover_color="#17a826" title_hover_color="#17a826" _builder_version="4.4.8" header_text_align="left" header_text_color="#ffffff" header_font_size="17px" read_more_icon="%%20%%" text_orientation="center" custom_margin="5px|1px|5px|1px|false|false" custom_padding="0px|0px|0px|0px|false|false" animation_style="fade" locked="off"]

By using our cloud-based data visualisation platform to bring together relevant metrics, we help organisations gain a standardised view and improve your ESG reporting and portfolio performance. Our live ESG dashboard can be used to scenario plan, map out ESG strategy and tell the ESG story to stakeholders.

[/et_pb_blurb_extended][/et_pb_column][et_pb_column type="1_3" _builder_version="4.4.8"][et_pb_blurb_extended title="Accelerating the collection of ESG metrics using AI" use_icon="on" font_icon="%%389%%" icon_color="#ffffff" use_icon_font_size="on" icon_font_size="39px" icon_hover_color="#17a826" style_icon="on" icon_shape="use_circle" use_shape_border="on" shape_border_color="#ffffff" shape_border_hover_color="#17a826" title_hover_color="#17a826" _builder_version="4.4.8" header_text_align="left" header_text_color="#ffffff" header_font_size="17px" read_more_icon="%%20%%" text_orientation="center" custom_margin="5px|1px|5px|1px|false|false" custom_padding="0px|0px|0px|0px|false|false" animation_style="fade" locked="off"]

AI helps with the process of ingesting, analysing and distributing data as well as offering predictive abilities and assessing trends in the ESG space. Leading Point is helping our AI startup partnerships adapt their technology to pursue this new opportunity, implementing these solutions into investment firms and supporting them with the use of the technology and data management.

[/et_pb_blurb_extended][/et_pb_column][et_pb_column type="1_3" _builder_version="4.4.8"][et_pb_blurb_extended title="Assisting companies to implement upcoming EU ESG regulations" use_icon="on" font_icon="%%392%%" icon_color="#ffffff" use_icon_font_size="on" icon_font_size="39px" icon_hover_color="#17a826" style_icon="on" icon_shape="use_circle" use_shape_border="on" shape_border_color="#ffffff" shape_border_hover_color="#17a826" title_hover_color="#17a826" _builder_version="4.4.8" header_text_align="left" header_text_color="#ffffff" header_font_size="17px" read_more_icon="%%20%%" text_orientation="center" custom_margin="5px|1px|5px|1px|false|false" custom_padding="0px|0px|0px|0px|false|false" animation_style="fade" locked="off"]

Implementing ESG regulations and providing operational support to improve ESG metrics for banks and other financial institutions. Ensuring compliance by benchmarking and disclosing ESG information, in-depth data collection to satisfy corporate reporting requirements, conducting appropriate investment and risk management decisions, and to make disclosures to clients and fund investors.

[/et_pb_blurb_extended][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built="1" _builder_version="3.22.3" animation_style="fade" locked="off"][et_pb_row _builder_version="3.25"][et_pb_column type="4_4" _builder_version="3.25" custom_padding="|||" custom_padding__hover="|||"][et_pb_text admin_label="Contact Us" module_class="txtblue" _builder_version="3.27.4" text_font="||||||||" link_font="||||||||" ul_font="||||||||" text_orientation="center"]

Contact Us

[/et_pb_text][et_pb_text admin_label="Form" _builder_version="3.27.4"][formidable id=2][/et_pb_text][et_pb_code admin_label="Social media icons" module_class="form" _builder_version="3.19.4" custom_margin="0px||0px" custom_padding="0px||0px"]

- Connect

[/et_pb_code][/et_pb_column][/et_pb_row][/et_pb_section]

Artificial Intelligence: The Solution to the ESG Data Gap?

The Power of ESG Data

It was Warren Buffett who said, “It takes twenty years to build a reputation and five minutes to ruin it” and that is the reality that all companies face on a daily basis. An effective set of ESG (Environment, Social & Governance) policies has never been more crucial. However, it is being hindered by difficulties surrounding the effective collection and communication of ESG data points, as well a lack of standardisation when it comes to reporting such data. As a result, the ESG space is being revolutionised by Artificial Intelligence, which can find, analyse and summarise this information.

There is increasing public and regulatory pressure on firms to ensure their policies are sustainable and on investors to take such policies into account when making investment decisions. The issue for investors is how to know which firms are good ESG performers and which are not. The majority of information dominating research and ESG indices comes from company-reported data. However, with little regulation surrounding this, responsible investors are plagued by unhelpful data gaps and “Greenwashing”. This is when a firm uses favourable data points and convoluted wording to appear more sustainable than they are in reality. They may even leave out data points that reflect badly on them. For example, firms such as Shell are accused of using the word ‘sustainable’ in their mission statement whilst providing little evidence to support their claims (1).

Could AI be the complete solution?

AI could be the key to help investors analyse the mountain of ESG data that is yet to be explored, both structured and unstructured. Historically, AI has been proven to successfully extract relevant information from data sources including news articles but it also offers new and exciting opportunities. Consider the transcripts of board meetings from a Korean firm: AI could be used to translate and examine such data using techniques such as Sentiment Analysis. Does the CEO seem passionate about ESG issues within the company? Are they worried about an investigation into Human Rights being undertaken against them? This is a task that would be labour-intensive, to say the least, for analysts to complete manually.

In addition, AI offers an opportunity for investors to not only act responsibly, but also align their ESG goals to a profitable agenda. For example, algorithms are being developed that can connect specific ESG indicators to financial performance and can therefore be used by firms to identify the risk and reward of certain investments.

Whilst AI offers numerous opportunities with regards to ESG investing, it is not without fault. Firstly, AI takes enormous amounts of computing power and, hence, energy. For example, in 2018, OpenAI found the level of computational power used to train the largest AI models has been doubling every 3.4 months since 2012 (2). With the majority of the world’s energy coming from non-renewable sources, it is not difficult to spot the contradiction in motives here. We must also consider whether AI is being used to its full potential; when simply used to scan company published data, AI could actually reinforce issues such as “Greenwashing”. Further, the issue of fake news and unreliable sources of information still plagues such methods and a lot of work has to go into ensuring these sources do not feature in algorithms used.

When speaking with Dr Thomas Kuh, Head of Index at leading ESG data and AI firm Truvalue Labs™, he outlined the difficulties surrounding AI but noted that since it enables human beings to make more intelligent decisions, it is surely worth having in the investment process. In fact, he described the application of AI to ESG research as ‘inevitable’ as long as it is used effectively to overcome the shortcomings of current research methods. For instance, he emphasised that AI offers real time information that traditional sources simply cannot compete with.

A Future for AI?

According to a 2018 survey from Greenwich Associates (3), only 17% of investment professionals currently use AI as part of their process; however, 40% of respondents stated they would increase budgets for AI in the future. As an area where investors are seemingly unsatisfied with traditional data sources, ESG is likely to see more than its fair share of this increase. Firms such as BNP Paribas (4) and Ecofi Investissements (5) are already exploring AI opportunities and many firms are following suit. We at Leading Point see AI inevitably becoming integral to an effective responsible investment process and intend to be at the heart of this revolution.

AI is by no means the judge, jury and executioner when it comes to ESG investing and depends on those behind it, constantly working to improve the algorithms, as well as the analysts using it to make more informed decisions. AI does, however, have the potential to revolutionise what a responsible investment means and help reallocate resources towards firms that will create a better future.

[1] The problem with corporate greenwashing

[2] AI and Compute

[3] Could AI Displace Investment Bank Research?

[4] How AI could shape the future of investment banking

[5] How AI Can Help Find ESG Opportunities

"It takes twenty years to build a reputation and five minutes to ruin it"

AI offers an opportunity for investors to not only act responsibly, but also align their ESG goals to a profitable agenda

Environmental Social Governance (ESG) & Sustainable Investment

Client propositions and products in data driven transformation in ESG and Sustainable Investing. Previous roles include J.P. Morgan, Morgan Stanley, and EY.

Upcoming blogs:

This is the second in a series of blogs that will explore the ESG world: its growth, its potential opportunities and the constraints that are holding it back. We will explore the increasing importance of ESG and how it affects business leaders, investors, asset managers, regulatory actors and more.

Riding the ESG Regulatory Wave: In the third part of our Environmental, Social and Governance (ESG) blog series, Alejandra explores the implementation challenges of ESG regulations hitting EU Asset Managers and Financial Institutions.

Is it time for VCs to take ESG seriously? In the fourth part of our Environmental, Social and Governance (ESG) blog series, Ben explores the current research on why startups should start implementing and communicating ESG policies at the core of their business.

Now more than ever, businesses are understanding the importance of having well-governed and socially-responsible practices in place. A clear understanding of your ESG metrics is pivotal in order to communicate your ESG strengths to investors, clients and potential employees.

By using our cloud-based data visualisation platform to bring together relevant metrics, we help organisations gain a standardised view and improve your ESG reporting and portfolio performance. Our live ESG dashboard can be used to scenario plan, map out ESG strategy and tell the ESG story to stakeholders.

AI helps with the process of ingesting, analysing and distributing data as well as offering predictive abilities and assessing trends in the ESG space. Leading Point is helping our AI startup partnerships adapt their technology to pursue this new opportunity, implementing these solutions into investment firms and supporting them with the use of the technology and data management.

We offer a specialised and personalised service based on firms’ ESG priorities. We harness the power of technology and AI to bridge the ESG data gap, avoiding ‘greenwashing’ data trends and providing a complete solution for organisations.

Leading Point's AI-implemented solutions decrease the time and effort needed to monitor current/past scandals of potential investments. Clients can see the benefits of increased output, improved KPIs and production of enhanced data outputs.

Implementing ESG regulations and providing operational support to improve ESG metrics for banks and other financial institutions. Ensuring compliance by benchmarking and disclosing ESG information, in-depth data collection to satisfy corporate reporting requirements, conducting appropriate investment and risk management decisions, and to make disclosures to clients and fund investors.