Streamlining financial services workflows with Verifiable Legal Entity Identifiers (vLEIs)

Source: GLIEF

Trust is hard to come by

How do you trust people you have never met in businesses you have never dealt with before? It was difficult 20 years ago and even more so today. Many checks are needed to verify if the person you are talking to is the person you think it is. Do they even work for the business they claim to represent? Failures of these checks manifest themselves every day with spear phishing incidents hitting the headlines, where an unsuspecting clerk is badgered into making a payment to a criminal’s account by a person claiming to be a senior manager.

With businesses increasing their cross-border business and more remote working, it is getting harder and harder to trust what you see in front of you. How do financial services firms reduce the risk of cybercrime attacks? At a corporate level, there are Legal Entity Identifiers (LEIs) which have been a requirement for regulated financial services businesses to operate in capital markets, OTC derivatives, fund administration or debt issuance.

LEIs are issued by Local Operating Units (LOUs). These are bodies that are accredited by GLEIF (Global Legal Entity Identifier Foundation) to issue LEIs. Examples of LOUs are the London Stock Exchange Group (LSEG) and Bloomberg. However, LEIs only work at a legal entity level for an organisation. LEIs are not used for individuals within organisations.

Establishing trust at this individual level is critical to reducing risk and establishing digital trust is key to streamlining workflows in financial services, like onboarding, trade finance, and anti-financial crime.

This is where Verifiable Legal Entity Identifiers (vLEIs) come into the picture.

What is the new vLEI initiative and how will it be used?

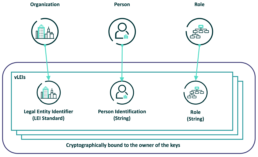

Put simply, vLEIs combine the organisation’s identity (the existing LEI), a person, and the role they play in the organisation into a cryptographically-signed package.

GLEIF has been working to create a fully digitised LEI service enabling instant and automated identity verification between counterparties across the globe. This drive for instant automation has been made possible by developments in blockchain technology, self-sovereign identity (SSI) and other decentralised key management platforms (Introducing the verifiable LEI (vLEI), GLEIF website).

vLEIs are secure digitally-signed credentials and a counterpart of the LEI, which is a unique 20-digit alphanumeric ISO-standardised code used to represent a single legal organisation. The vLEI cryptographically encompasses three key elements; the LEI code, the person identification string, and the role string, to form a digital credential of a vLEI. The GLEIF database and repository provides a breakdown of key information on each registered legal entity, from the registered location, the legal entity name, as well as any other key information pertaining to the registered entity or its subsidiaries, as GLEIF states this is of “principally ‘who is who’ and ‘who owns whom’”(GLEIF eBook: The vLEI: Introducing Digital I.D. for Legal Entities Everywhere, GLEIF Website).

In December 2022, GLEIF launched their first vLEI services through proof-of-concept (POC) trials, offering instant digitally verifiable credentials containing the LEI. This is to meet GLEIF’s goal to create a standardised, digitised service capable of enabling instant, automated trust between legal entities and their authorised representatives, and the counterparty legal entities and representatives with which they interact” (GLEIF eBook: The vLEI: Introducing Digital I.D. for Legal Entities Everywhere, page 2).

“The vLEI has the potential to become one of the most valuable digital credentials in the world because it is the hallmark of authenticity for a legal entity of any kind. The digital credentials created by GLEIF and documented in the vLEI Ecosystem Governance Framework can serve as a chain of trust for anyone needing to verify the legal identity of an organisation or a person officially acting on that organisation’s behalf. Using the vLEI, organisations can rely upon a digital trust infrastructure that can benefit every country, company, and consumers worldwide”,

Karla McKenna, Managing Director GLEIF Americas

This new approach for the automated verification of registered entities will benefit many organisations and businesses. It will enhance and speed up regulatory reports and filings, due diligence, e-signatures, client onboarding/KYC, business registration, as well as other wider business scenarios.

Imagine the spear phishing example in the introduction. A spoofed email will not have a valid vLEI cryptographic signature, so can be rejected (even automatically), saving potentially thousands of £.

How do I get a vLEI?

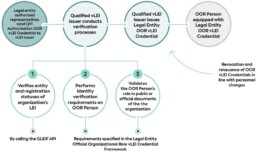

Registered financial entities can obtain a vLEI from a Qualified vLEI Issuer (QVI) organisation to benefit from instant verification, when dealing with other industries or businesses (Get a vLEI: List of Qualified vLEI Issuing Organisations, GLEIF Website).

A QVI organisation is authorised under GLEIF to register, renew or revoke vLEI credentials belonging to any financial entity. GLEIF offers a Qualification Program where organisations can apply to operate as a QVI. GLEIF maintain a list of QVIs on their website.

Source: GLIEF

What is the new ISO 5009:2022 and why is it relevant?

The International Organisation of Standards (ISO) published the ISO 5009 standard in 2022, which was initially proposed by GLEIF, for the financial services sector. This is a new scheme to address “the official organisation roles in a structured way in order to specify the roles of persons acting officially on behalf of an organisation or legal entity” (ISO 5009:2022, ISO.org).

Both ISO and GLEIF have created and developed this new scheme of combining organisation roles with the LEI, to enable digital identity management of credentials. This is because the ISO 5009 scheme offers a standard way to specify organisational roles in two types of LEI-based digital assets, being the public key certificates with embedded LEIs, as per X.509 (ISO/IEC 9594-8), also outlined in ISO 17442-2, or for digital verifiable credentials such as vLEIs to be specified, to help confirm the authenticity of a person’s role, who acts on behalf of an organisation (ISO 5009:2022, ISO Website). This will help speed up the validation of person(s) acting on behalf of an organisation, for regulatory requirements and reporting, as well as for ID verification, across various business use cases.

Leading Point have been supporting GLEIF in the analysis and implementation of the new ISO 5009 standard, for which GLEIF acts as the operating entity to maintain the ISO 5009 standard on behalf of ISO. Identifying and defining OORs was dependent on accurate assessments of hundreds of legal documents by Leading Point.

“We have seen first-hand the challenges of establishing identity in financial services and were proud to be asked to contribute to establishing a new standard aimed at solving this common problem. As data specialists, we continuously advocate the benefits of adopting standards. Fragmentation and trying to solve the same problem multiple times in different ways in the same organisation hurts the bottom line. Fundamentally, implementing vLEIs using ISO 5009 roles improves the customer experience, with quicker onboarding, reduced fraud risk, faster approvals, and most importantly, a higher level of trust in the business.”

Rajen Madan (Founder and CEO, Leading Point)

Thushan Kumaraswamy (Founding Partner & CTO, Leading Point)

How can Leading Point assist?

Our team of expert practitioners can assist financial entities to implement the ISO 5009 standard in their workflows for trade finance, anti-financial crime, KYC and regulatory reporting. We are fully-equipped to help any organisation that is looking to get vLEIs for their senior team and to incorporate vLEIs into their business processes, reducing costs, accelerating new business growth, and preventing anti-financial crime.

Glossary of Terms and Additional Information on GLEIF

Who is GLEIF?

The Global Legal Entity Identifier Foundation (GLEIF) was established by the Financial Stability Board (FSB) in June 2014 and as part of the G20 agenda to endorse a global LEI. The GLEIF organisation helps to implement the use of the Legal Entity Identifier (LEI) and is headquartered in Basel, Switzerland.

What is an LEI?

A Legal Entity Identifier (LEI) is a unique 20 alphanumeric character code based on the ISO-17442 standard. This is a unique identification code for legal financial entities that are involved in financial transactions. The role of the structure of how an LEI is concatenated, principally answers ‘who is who’ and ‘who owns whom’, as per ISO and GLEIF standards, for entity verification purposes and to improve data quality in financial regulatory reports.

How does GLEIF help?

GLEIF not only helps to implement the use of LEI, but it also offers a global reference data and central repository on LEI information via the Global LEI Index on gleif.org, which is an online, public, open, standardised, and a high-quality searchable tool for LEIs, which includes both historical and current LEI records.

What is GLEIF’S Vision?

GLEIF believe that each business involved in financial transactions should be identifiable with a unique single digital global identifier. GLEIF look to increase the rate of LEI adoption globally so that the Global LEI Index can include all global financial entities that engage in financial trading activities. GLEIF believes this will encourage market participants to reduce operational costs and burdens and will offer better insight into the global financial markets (Our Vision: One Global Identity Behind Every Business, GLEIF Website).

Rajen Madan