Helping Bloomberg improve its data offering for its customers

Bloomberg wanted us to help review and refresh their 80,000 data terms in order to build a clear ontology of related information. We identified & prioritised the core, essential terms and designed new business rules for the data relationships. By creating a system-based approach, we could train the Bloomberg team to continue our work as BAU.

We improved the definitions, domains, and ranges to align with new ontologies, enabling their 300,000 financial services professionals to make more informed investment decisions.

Helping GLEIF build out a new ISO standard for official organisational roles (ISO 5009)

GLEIF engaged us as financial services data experts to identify, analyse, and recommend relevant organisational roles for in-scope jurisdictions based on publicly-available laws & regulations. We looked at 12 locations in a four-week proof-of-concept, using automated document processing

Our work helped GLEIF to launch the ISO 5009 in 2022, enabling B2B verified digital signatures for individuals working in official roles. This digital verification speeds up onboarding time and increases trust.

Developing a GTM strategy at a large alternative data provider to break into new financial services markets

"Leading Point’s delivery has been head and shoulders above any other consultancy I have ever worked with."

SVP Large Alternative Data Provider

Increasing data product offerings by profiling 80k terms at a global data provider

“Through domain & technical expertise Leading Point have been instrumental in the success of this project to analyse and remediate 80k industry terms. LP have developed a sustainable process, backed up by technical tools, allowing the client to continue making progress well into the future. I would have no hesitation recommending LP as a delivery partner to any firm who needs help untangling their data.”

PM at Global Market Data Provider

AI in Insurance - Article 1 - A Catalyst for Innovation

How insurance companies can use the latest AI developments to innovate their operations

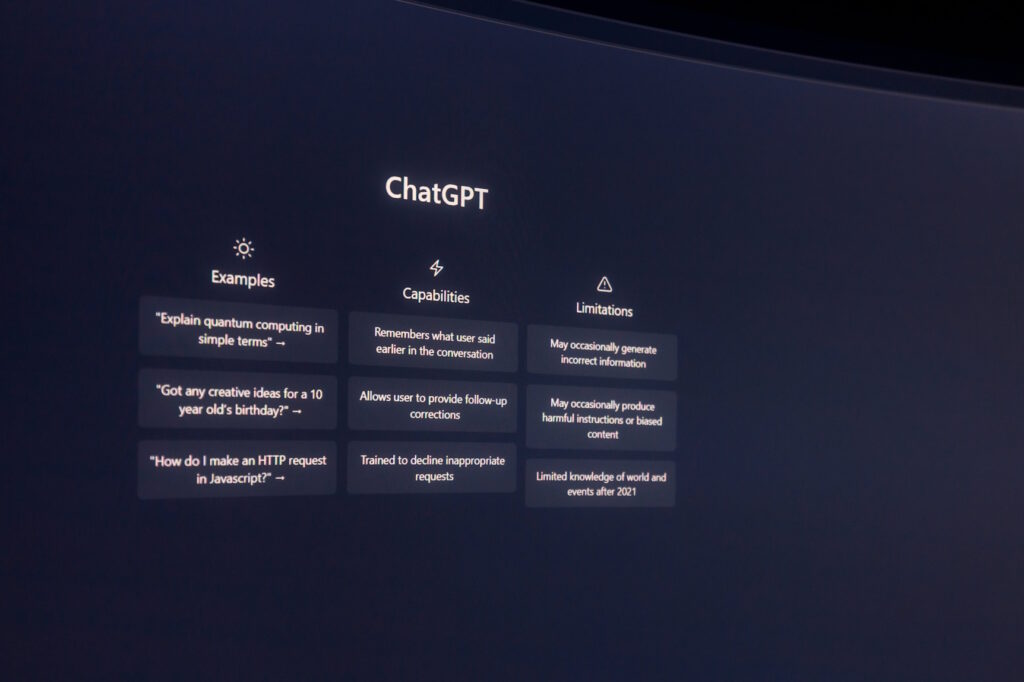

The emergence of AI

The insurance industry is undergoing a profound transformation driven by the relentless advance of artificial intelligence (AI) and other disruptive technologies. A significant change in business thinking is gaining pace and Applied AI is being recognised for its potential in driving top-line growth and not merely a cost-cutting tool.

The adoption of AI is poised to reshape the insurance industry, enhancing operational efficiencies, improving decision-making, anticipating challenges, delivering innovative solutions, and transforming customer experiences.

This shift from data-driven to AI-driven operations is bringing about a paradigm shift in how insurance companies collect, analyse, and utilise data to make informed decisions and enhance customer experiences. By analysing vast amounts of data, including historical claims records, market forces, and external factors (global events like hurricanes, and regional conflicts), AI can assess risk with speed and accuracy to provide insurance companies a view of their state of play in the market.

Data vs AI approaches

This data-driven approach has enabled insurance companies to improve their underwriting accuracy, optimise pricing models, and tailor products to specific customer needs. However, the limitations of traditional data analytics methods have become increasingly apparent in recent years.

These methods often struggle to capture the complex relationships and hidden patterns within large datasets. They are also slow to adapt to rapidly-changing market conditions and emerging risks. As a result, insurance companies are increasingly turning to AI to unlock the full potential of their data and drive innovation across the industry.

AI algorithms, powered by machine learning and deep learning techniques, can process vast amounts of data far more efficiently and accurately than traditional methods. They can connect disparate datasets, identify subtle patterns, correlations & anomalies that would be difficult or impossible to detect with human analysis.

By leveraging AI, insurance companies can gain deeper insights into customer behaviour, risk factors, and market trends. This enables them to make more informed decisions about underwriting, pricing, product development, and customer service and gain a competitive edge in the ever-evolving marketplace.

Top 5 opportunities

1. Enhanced Risk Assessment

AI algorithms can analyse a broader range of data sources, including social media posts and weather patterns, to provide more accurate risk assessments. This can lead to better pricing and reduced losses.

2. Personalised Customer Experiences

AI can create personalised customer experiences, from tailored product recommendations to proactive risk mitigation guidance. This can boost customer satisfaction and loyalty.

3. Automated Claims Processing

AI can automate routine claims processing tasks, for example, by reviewing claims documentation and providing investigation recommendations, thus reducing manual efforts and improving efficiency. This can lead to faster claims settlements and lower operating costs.

4. Fraud Detection and Prevention

AI algorithms can identify anomalies and patterns in claims data to detect and prevent fraudulent activities. This can protect insurance companies from financial losses and reputational damage.

5. Predictive Analytics

AI can be used to anticipate future events, such as customer churn or potential fraud. This enables insurance companies to take proactive measures to prevent negative outcomes.

Adopting AI in Insurance

The adoption of AI in the insurance industry is not without its challenges. Insurance companies must address concerns about data quality, data privacy, transparency, and potential biases in AI algorithms. They must also ensure that AI is integrated seamlessly into their existing systems and processes.

Despite these challenges, AI presents immense opportunities. Insurance companies that embrace AI-driven operations will be well-positioned to gain a competitive edge, enhance customer experiences, and navigate the ever-changing risk landscape.

The shift from data-driven to AI-driven operations is a transformative force in the insurance industry. AI is not just a tool for analysing data; it is a catalyst for innovation and a driver of change. Insurance companies that harness the power of AI will be at the forefront of this transformation, shaping the future of insurance and delivering exceptional value to their customers.

Download the PDF article here.

Unlocking the opportunity of vLEIs

Streamlining financial services workflows with Verifiable Legal Entity Identifiers (vLEIs)

Source: GLIEF

Trust is hard to come by

How do you trust people you have never met in businesses you have never dealt with before? It was difficult 20 years ago and even more so today. Many checks are needed to verify if the person you are talking to is the person you think it is. Do they even work for the business they claim to represent? Failures of these checks manifest themselves every day with spear phishing incidents hitting the headlines, where an unsuspecting clerk is badgered into making a payment to a criminal’s account by a person claiming to be a senior manager.

With businesses increasing their cross-border business and more remote working, it is getting harder and harder to trust what you see in front of you. How do financial services firms reduce the risk of cybercrime attacks? At a corporate level, there are Legal Entity Identifiers (LEIs) which have been a requirement for regulated financial services businesses to operate in capital markets, OTC derivatives, fund administration or debt issuance.

LEIs are issued by Local Operating Units (LOUs). These are bodies that are accredited by GLEIF (Global Legal Entity Identifier Foundation) to issue LEIs. Examples of LOUs are the London Stock Exchange Group (LSEG) and Bloomberg. However, LEIs only work at a legal entity level for an organisation. LEIs are not used for individuals within organisations.

Establishing trust at this individual level is critical to reducing risk and establishing digital trust is key to streamlining workflows in financial services, like onboarding, trade finance, and anti-financial crime.

This is where Verifiable Legal Entity Identifiers (vLEIs) come into the picture.

What is the new vLEI initiative and how will it be used?

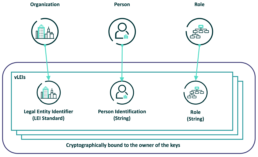

Put simply, vLEIs combine the organisation’s identity (the existing LEI), a person, and the role they play in the organisation into a cryptographically-signed package.

GLEIF has been working to create a fully digitised LEI service enabling instant and automated identity verification between counterparties across the globe. This drive for instant automation has been made possible by developments in blockchain technology, self-sovereign identity (SSI) and other decentralised key management platforms (Introducing the verifiable LEI (vLEI), GLEIF website).

vLEIs are secure digitally-signed credentials and a counterpart of the LEI, which is a unique 20-digit alphanumeric ISO-standardised code used to represent a single legal organisation. The vLEI cryptographically encompasses three key elements; the LEI code, the person identification string, and the role string, to form a digital credential of a vLEI. The GLEIF database and repository provides a breakdown of key information on each registered legal entity, from the registered location, the legal entity name, as well as any other key information pertaining to the registered entity or its subsidiaries, as GLEIF states this is of “principally ‘who is who’ and ‘who owns whom’”(GLEIF eBook: The vLEI: Introducing Digital I.D. for Legal Entities Everywhere, GLEIF Website).

In December 2022, GLEIF launched their first vLEI services through proof-of-concept (POC) trials, offering instant digitally verifiable credentials containing the LEI. This is to meet GLEIF’s goal to create a standardised, digitised service capable of enabling instant, automated trust between legal entities and their authorised representatives, and the counterparty legal entities and representatives with which they interact” (GLEIF eBook: The vLEI: Introducing Digital I.D. for Legal Entities Everywhere, page 2).

“The vLEI has the potential to become one of the most valuable digital credentials in the world because it is the hallmark of authenticity for a legal entity of any kind. The digital credentials created by GLEIF and documented in the vLEI Ecosystem Governance Framework can serve as a chain of trust for anyone needing to verify the legal identity of an organisation or a person officially acting on that organisation’s behalf. Using the vLEI, organisations can rely upon a digital trust infrastructure that can benefit every country, company, and consumers worldwide”,

Karla McKenna, Managing Director GLEIF Americas

This new approach for the automated verification of registered entities will benefit many organisations and businesses. It will enhance and speed up regulatory reports and filings, due diligence, e-signatures, client onboarding/KYC, business registration, as well as other wider business scenarios.

Imagine the spear phishing example in the introduction. A spoofed email will not have a valid vLEI cryptographic signature, so can be rejected (even automatically), saving potentially thousands of £.

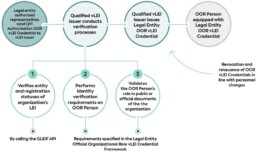

How do I get a vLEI?

Registered financial entities can obtain a vLEI from a Qualified vLEI Issuer (QVI) organisation to benefit from instant verification, when dealing with other industries or businesses (Get a vLEI: List of Qualified vLEI Issuing Organisations, GLEIF Website).

A QVI organisation is authorised under GLEIF to register, renew or revoke vLEI credentials belonging to any financial entity. GLEIF offers a Qualification Program where organisations can apply to operate as a QVI. GLEIF maintain a list of QVIs on their website.

Source: GLIEF

What is the new ISO 5009:2022 and why is it relevant?

The International Organisation of Standards (ISO) published the ISO 5009 standard in 2022, which was initially proposed by GLEIF, for the financial services sector. This is a new scheme to address “the official organisation roles in a structured way in order to specify the roles of persons acting officially on behalf of an organisation or legal entity” (ISO 5009:2022, ISO.org).

Both ISO and GLEIF have created and developed this new scheme of combining organisation roles with the LEI, to enable digital identity management of credentials. This is because the ISO 5009 scheme offers a standard way to specify organisational roles in two types of LEI-based digital assets, being the public key certificates with embedded LEIs, as per X.509 (ISO/IEC 9594-8), also outlined in ISO 17442-2, or for digital verifiable credentials such as vLEIs to be specified, to help confirm the authenticity of a person’s role, who acts on behalf of an organisation (ISO 5009:2022, ISO Website). This will help speed up the validation of person(s) acting on behalf of an organisation, for regulatory requirements and reporting, as well as for ID verification, across various business use cases.

Leading Point have been supporting GLEIF in the analysis and implementation of the new ISO 5009 standard, for which GLEIF acts as the operating entity to maintain the ISO 5009 standard on behalf of ISO. Identifying and defining OORs was dependent on accurate assessments of hundreds of legal documents by Leading Point.

“We have seen first-hand the challenges of establishing identity in financial services and were proud to be asked to contribute to establishing a new standard aimed at solving this common problem. As data specialists, we continuously advocate the benefits of adopting standards. Fragmentation and trying to solve the same problem multiple times in different ways in the same organisation hurts the bottom line. Fundamentally, implementing vLEIs using ISO 5009 roles improves the customer experience, with quicker onboarding, reduced fraud risk, faster approvals, and most importantly, a higher level of trust in the business.”

Rajen Madan (Founder and CEO, Leading Point)

Thushan Kumaraswamy (Founding Partner & CTO, Leading Point)

How can Leading Point assist?

Our team of expert practitioners can assist financial entities to implement the ISO 5009 standard in their workflows for trade finance, anti-financial crime, KYC and regulatory reporting. We are fully-equipped to help any organisation that is looking to get vLEIs for their senior team and to incorporate vLEIs into their business processes, reducing costs, accelerating new business growth, and preventing anti-financial crime.

Glossary of Terms and Additional Information on GLEIF

Who is GLEIF?

The Global Legal Entity Identifier Foundation (GLEIF) was established by the Financial Stability Board (FSB) in June 2014 and as part of the G20 agenda to endorse a global LEI. The GLEIF organisation helps to implement the use of the Legal Entity Identifier (LEI) and is headquartered in Basel, Switzerland.

What is an LEI?

A Legal Entity Identifier (LEI) is a unique 20 alphanumeric character code based on the ISO-17442 standard. This is a unique identification code for legal financial entities that are involved in financial transactions. The role of the structure of how an LEI is concatenated, principally answers ‘who is who’ and ‘who owns whom’, as per ISO and GLEIF standards, for entity verification purposes and to improve data quality in financial regulatory reports.

How does GLEIF help?

GLEIF not only helps to implement the use of LEI, but it also offers a global reference data and central repository on LEI information via the Global LEI Index on gleif.org, which is an online, public, open, standardised, and a high-quality searchable tool for LEIs, which includes both historical and current LEI records.

What is GLEIF’S Vision?

GLEIF believe that each business involved in financial transactions should be identifiable with a unique single digital global identifier. GLEIF look to increase the rate of LEI adoption globally so that the Global LEI Index can include all global financial entities that engage in financial trading activities. GLEIF believes this will encourage market participants to reduce operational costs and burdens and will offer better insight into the global financial markets (Our Vision: One Global Identity Behind Every Business, GLEIF Website).

Séverine Raymond Soulier's Interview with Leading Point

Séverine Raymond Soulier’s Interview with Leading Point

Séverine Raymond Soulier is the recently appointed Head of EMEA at Symphony.com – the secure, cloud-based, communication and content sharing platform. Séverine has over a decade of experience within the Investment Banking sector and following 9 years with Thomson Reuters (now Refinitiv) where she was heading the Investment and Advisory division for EMEA leading a team of senior market development managers in charge of the Investing and Advisory revenue across the region. Séverine brings a wealth of experience and expertise to Leading Point, helping expand its product portfolio and its reach across international markets.

John Macpherson's Interview with Leading Point

John Macpherson’s Interview with Leading Point 2022

John Macpherson was the former CEO of BMLL Technologies; and is a veteran of the city, holding several MD roles at CITI, Nomura and Goldman Sachs. In recent years John has used his extensive expertise to advise start-ups and FinTech in challenges ranging from compliance to business growth strategy. John is Deputy Chair of the Investment Association Engine which is the trade body and industry voice for over 200+ UK investment managers and insurance companies.

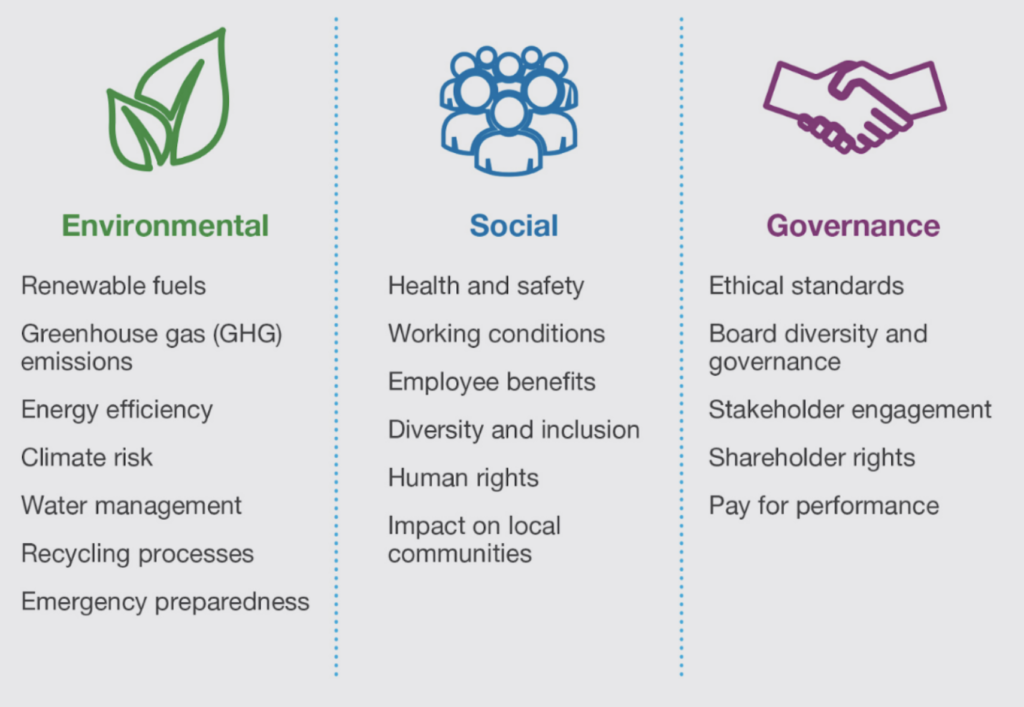

ESG Operating models hold the key to ESG compliance

John Macpherson on ESG Risk

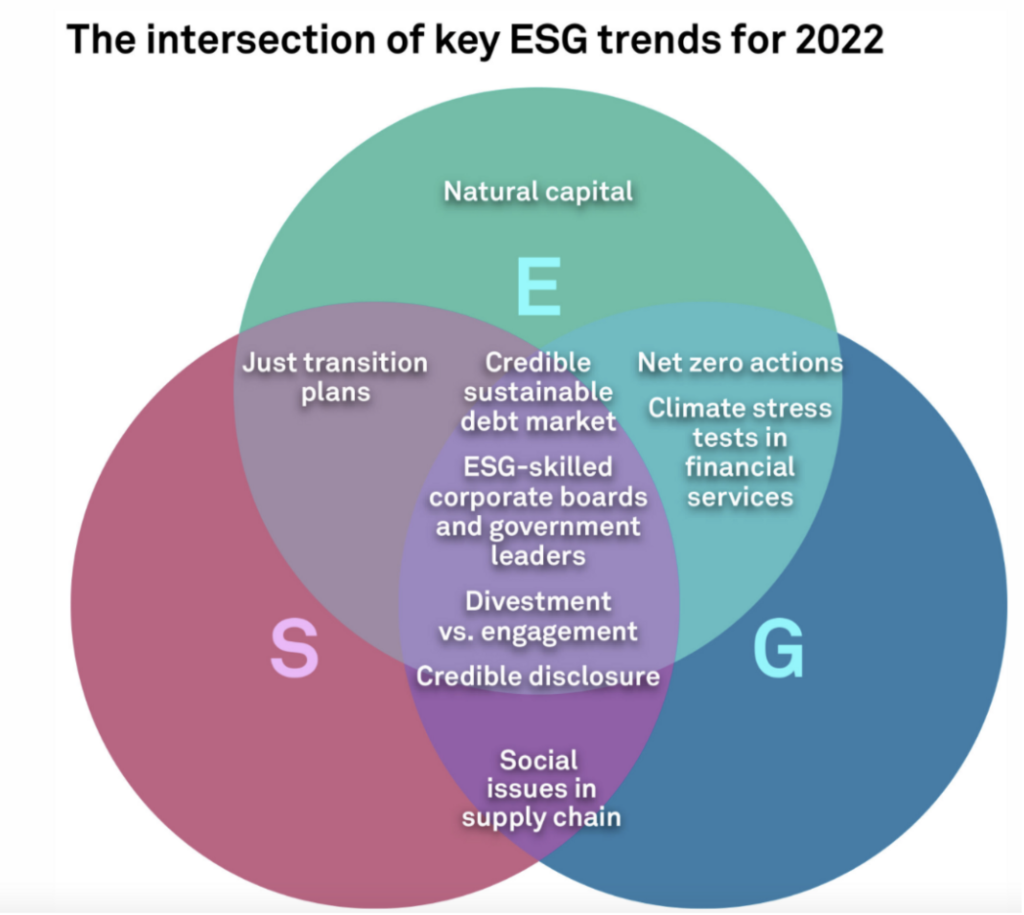

In my last article, I wrote about the need for an effective operating model in the handling and optimisation of data for Financial Services firms. But data is only one of several key trends amongst these firms that would benefit from a digital operating model. ESG has risen the ranks in importance, and the reporting of this has become imperative.

The Investment Association Engine Program, which I Chair, is designed to identify the most relevant pain points and key themes amongst Asset and Investment Management clients. We do this by searching out FinTech businesses that are already working on solutions to these issues. By partnering with these businesses, we can help our clients overcome their challenges and improve their operations.

While data has been an ever-present issue, ESG has risen to an equal standing of importance over the last couple of years. Different regulatory jurisdictions and expectations worldwide has left SME firms struggling to comply and implement in a new paradigm of environmental, sustainable and governance protocols.

ESG risk is different to anything we have experienced before and does not fit into neat categories such as areas like operational risk. The depth and breadth of data and models required for firms to make informed strategic decisions varies widely based on the specific issue at hand (e.g., supply chain, reputation, climate change goals, etc.). Firms need to carefully consider their own position and objectives when determining how much analysis is needed.

According to S&P Global, sustainable debt issuance reached a record level in 2021, and is only expected to increase further in the coming years. With this growth comes increased scrutiny and a heightened concern of so-called ‘greenwashing’, where companies falsely claim to be environmentally friendly. To combat this, participants need to manage that growth in a way that combats rising concerns about ‘greenwashing’.

Investors, regulators and the public, in general, are keen to challenge large companies’ ESG goals and results. These challenges vary wildly, but the biggest seen on a regular basis range from human rights to social unrest and climate change. As organisations begin to decarbonise their operations, they face the initially overlooked challenge of creating a credible near-term plan that will enable them to reach their long-term sustainability goals.

Investor pressure on climate change has historically focussed on the Energy sector. Now central banks are trying to incorporate climate risk as a stress testing feature for all Financial Services firms.

Source: S&P Global

Operating models hold the key to ESG transition and compliance. Having an operating model for how each of the firm’s functions intersect with ESG, requires new processes, new data, and new reporting techniques. This needs to be pulled across the enterprise, so firms have a process that is substantiated.

Before firms worry about ESG scores from their market data providers, they would do well to look closely at their own operating model and framework. In this way, they can then pull in the data required from the marketplace and use it in anger.

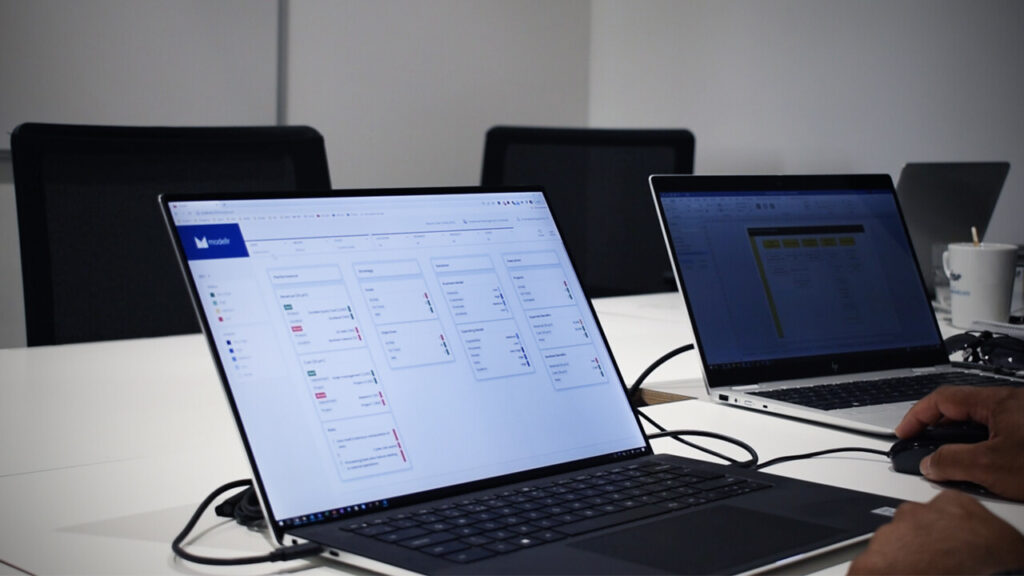

Leading Point is a FinTech business I am proud to be supporting. Their operating model system, modellr™ describes how financial services businesses work, from the products and services offered, to the key processes, people, data, and technology used to deliver value to their customers. This digital representation of how the business works is crucial to show what areas ESG will impact and how the firm can adapt in the most effective way.

Rajen Madan, CEO at Leading Point:

“In many ways, the transition to ESG is exposing the acute gap in firms of not being able to have meaningful dialogue with the plethora of data they already have, and need, to further add to for ESG”.

modellr™ harvests a company’s existing data to create a living dashboard, whilst also digitising the change process and enabling quicker and smarter decision-making. Access to all the information, from internal and external sources, in real time is proving transformative for SME size businesses.

Thushan Kumaraswamy, Chief Solutions Officer at Leading Point:

“ESG is already one of the biggest drivers of transformation in financial services and is only going to get bigger. Firms need to identify the impact on their business, choose the right change option, execute the strategy, and measure the improvements. The mass of ESG frameworks adds to the confusion of what to report and how. Tools such as modellr™ bring clarity and purpose to the ESG imperative.”

While most firms will look to sustainability officers for guidance on matters around ESG, Leading Point are providing these officers, and less qualified team members, with the tools to make informed decisions now, and in the future. We have established exactly what these firms need to succeed – a digital operating model.

Words by John Macpherson — Board advisor at Leading Point and Chair of the Investment Association Engine

The Challenges of Data Management

John Macpherson on The Challenges of Data Management

I often get asked, what are the biggest trends impacting the Financial Services industry? Through my position as Chair of the Investment Association Engine, I have unprecedented access to the key decision-makers in the industry, as well as constant connectivity with the ever-expanding Fintech ecosystem, which has helped me stay at the cutting edge of the latest trends.

So, when I get asked, ‘what is the biggest trend that financial services will face’, for the past few years my answer has remained the same, data.

During my time as CEO of BMLL, big data rose to prominence and developed into a multi-billion-dollar problem across financial services. I remember well an early morning interview I gave to CNBC around 5 years ago, where the facts were starkly presented. Back then, data was doubling every three years globally, but at an even faster pace in financial markets.

Firms are struggling under the weight of this data

The use of data is fundamental to a company's operations, but they are finding it difficult to get a handle on this problem. The pace of this increase has left many smaller and mid-sized IM/ AM firms in a quandary. Their ability to access, manage and use multiple data sources alongside their own data, market data, and any alternative data sources, is sub-optimal at best. Most core data systems are not architected to address the volume and pace of change required, with manual reviews and inputs creating unnecessary bottlenecks. These issues, among a host of others, mean risk management systems cannot cope as a result. Modernised data core systems are imperative to solve where real-time insights are currently lost, with fragmented and slow-moving information.

Around half of all financial service data goes unmentioned and ungoverned, this “dark data” poses a security and regulatory risk, as well as a huge opportunity.

While data analytics, big data, AI, and data science are historically the key sub-trends, these have been joined by data fabric (as an industry standard), analytical ops, data democratisation, and a shift from big data to smaller and wider data.

Operating models hold the key to data management

Governance is paramount to using this data in an effective, timely, accurate and meaningful way. Operating models are the true gauge as to whether you are succeeding.

Much can be achieved with the relatively modest budget and resources firms have, provided they invest in the best operating models around their data.

Leading Point is a firm I have been getting to know over several years now. Their data intelligence platform modellr™, is the first truly digital operating model. modellr™ harvests a company’s existing data to create a living operating model, digitising the change process, and enabling quicker, smarter, decision making. By digitising the process, they’re removing the historically slow and laborious consultative approach. Access to all the information in real-time is proving transformative for smaller and medium-sized businesses.

True transparency around your data, understanding it and its consumption, and then enabling data products to support internal and external use cases, is very much available.

Different firms are at very different places on their maturity curve. Longer-term investment in data architecture, be it data fabric or data mesh, will provide the technical backbone to harvest ML/ AI and analytics.

Taking control of your data

Recently I was talking to a large investment bank for whom Leading Point had been brought in to help. The bank was looking to transform its client data management and associated regulatory processes such as KYC, and Anti-financial crime.

They were investing heavily in sourcing, validating, normalising, remediating, and distributing over 2,000 data attributes. This was costing the bank a huge amount of time, money, and resources. But, despite the changes, their environment and change processes had become too complicated to have any chance of success. The process results were haphazard, with poor controls and no understanding of the results missing.

Leading Point was brought in to help and decided on a data minimisation approach. They profiled and analysed the data, despite working across regions and divisions. Quickly, 2,000 data attributes were narrowed to less than 200 critical ones for the consuming functions. This allowed the financial institutions, regulatory, and reporting processes to come to life, with clear data quality measurement and ownership processes. It allowed the financial institutions to significantly reduce the complexity of their data and its usability, meaning that multiple business owners were able to produce rapid and tangible results

I was speaking to Rajen Madan, the CEO of Leading Point, and we agreed that in a world of ever-growing data, data minimisation is often key to maximising success with data!

Elsewhere, Leading Point has seen benefits unlocked from unifying data models, and working on ontologies, standards, and taxonomies. Their platform, modellr™is enabling many firms to link their data, define common aggregations, and support knowledge graph initiatives allowing firms to deliver more timely, accurate and complete reporting, as well as insights on their business processes.

The need for agile, scalable, secure, and resilient tech infrastructure is more imperative than ever. Firms’ own legacy ways of handling this data are singularly the biggest barrier to their growth and technological innovation.

If you see a digital operating model as anything other than a must-have, then you are missing out. It’s time for a serious re-think.

Words by John Macpherson — Board advisor at Leading Point, Chair of the Investment Association Engine

John was recently interviewed about his role at Leading Point, and the key trends he sees affecting the financial services industry. Watch his interview here

Leading Point Shortlisted For Data Management Insight Awards

Leading Point has been shortlisted for the A-Teams Data Management Insight Awards.

Data Management Insight Awards, now in their seventh year, are designed to recognise leading providers of data management solutions, services and consultancy within capital markets.

Leading Point has been nominated for four categories:

- Most Innovative Data Management Provider

- Best Data Analytics Solution Provider

- Best Proposition for AI, Machine Learning, Data Science

- Best Consultancy in Data Management

Areas of Outstanding Service & Innovation

Leading Form Index: Data readiness assessment, created by Leading Point FM, which measures firms data capabilities and their capacity to transform across 24 unique areas. This allows participating firms to understand the maturity of their information assets, the potential to apply new tech (AI, DLT) and benchmark with peers.

Chief Risk Officer Dashboard: Management Information Dashboard that specifies, quantifies, and visualises risks arising from firms’ non-financial, operational, fraud, financial crime, and cyber risks.

Leading Point FM ‘Think Fast’ Application: The application provides the ability to input use cases and solution journeys and helps visualise process, systems and data flows, as well as target state definition & KPI’s. This allows business change and technology teams to quickly define and initiate change management.

Anti-Financial Crime Solution: Data centric approach combined with Artificial Intelligence technology reimagines and optimises AML processes to reduce volumes of client due diligence, reduce overall risk exposure, and provide the roadmap to AI-assisted automation.

Treasury Optimisation Solution: Data content expertise leveraging cutting edge DLT & Smart Contract technology to bridge intracompany data silos and enable global corporates to access liquidity and efficiently manage finance operations.

Digital Repapering Solution: Data centric approach to sourcing, management and distribution of unstructured data combined with NLP technology to provide roadmap towards AI assisted repapering and automated contract storage and distribution.

Leading Form Practical Business Design Canvas: A practical business design method to describe your business goals & objectives, change projects, capabilities, operating model, and KPI’s to enable a true business-on-a-page view that is captured within hours.

ISO 27001 Certification – Delivery of Information Security Management System (ISMS) & Cyber risk mitigation with a Risk Analysis Tool

GDFM & Leading Point Partnering for Smarter Regulatory Health Management

GDFM and Leading Point collaborate to deliver innovative and efficient regulatory risk management to our clients and through the SMART_Dash product; enabling consistent, centralised, accessible regulatory health data to assist responsible and accountable individuals with ensuring adequate transparency, for risk mitigation decision making and action taking. This is complemented by a SMART_Board suite for Board level leadership and a more detailed SMART_Support suite for regulatory reporting teams.

We are delighted that SMART_Dash has been shortlisted in 3 categories in this year's prestigious RegTech Insight Awards in Europe, which recognises both established solution providers and innovative newcomers, seeking to herald and highlight innovative RegTech solutions across the global financial services industry.

GD Financial Markets Head of Regulatory Compliance Practice and SMART_Dash Co-creator Sarah Peaston "Centralised, consolidated, consistent regulatory health transparency and tracking is key to identifying and managing regulatory and operating risk. I am delighted that SMART_Dash has been recognised as a new breed of solution that practically assists Managers, Senior Managers and Leadership with managing their regulatory health through the provision of the right information, at the right level to the right seniority”.

Leading Point CEO Rajen Madan "Our vision with SMART_Dash is to accelerate better regulatory risk management approaches and vastly more efficient RegOps. As financial services practitioners we are acutely aware of the time managers spend trying to make sense of their regulatory and operating risk areas from a multitude of inconsistent reports. SMART_Dash enables the shift to an enhanced way of risk management, which creates standardisation and makes reg data work for your business. We are very grateful to the COO, CRO and CFOs whom have contributed to its development and help the industry move forward”.

GDFM and Leading Point are rolling out the SMART_Dash suite to the first set of industry consortium partners progressively in H1 2021, and thereafter open to a wider set of institutions.

The Composable Enterprise: Improving the Front-Office User Experience

[et_pb_section fb_built="1" _builder_version="4.4.8" min_height="1084px" custom_margin="16px||-12px|||" custom_padding="0px||0px|||"][et_pb_row column_structure="2_3,1_3" _builder_version="3.25" custom_margin="-2px|auto||auto||" custom_padding="1px||3px|||"][et_pb_column type="2_3" _builder_version="3.25" custom_padding="|||" custom_padding__hover="|||"][et_pb_social_media_follow url_new_window="off" follow_button="on" _builder_version="4.4.8" text_orientation="left" module_alignment="left" min_height="14px" custom_margin="1px||5px|0px|false|false" custom_padding="0px|0px|0px|0px|false|false" border_radii="on|1px|1px|1px|1px"][et_pb_social_media_follow_network social_network="linkedin" url="https://uk.linkedin.com/company/leadingpoint" _builder_version="4.4.8" background_color="#007bb6" follow_button="on" url_new_window="off"]linkedin[/et_pb_social_media_follow_network][/et_pb_social_media_follow][et_pb_image src="https://leadingpointfm.com/wp-content/uploads/2020/10/cloud-based-services.png" title_text="cloud-based-services" align_tablet="center" align_phone="" align_last_edited="on|desktop" admin_label="Image" _builder_version="4.4.8" locked="off"][/et_pb_image][/et_pb_column][et_pb_column type="1_3" _builder_version="3.25" custom_padding="|||" custom_padding__hover="|||"][/et_pb_column][/et_pb_row][et_pb_row column_structure="1_2,1_2" _builder_version="4.4.8"][et_pb_column type="1_2" _builder_version="4.4.8"][et_pb_text _builder_version="4.4.8" text_font="||||||||" text_font_size="14px" text_line_height="1.6em" header_font="||||||||" header_font_size="25px" width="100%" custom_margin="10px|-34px|-5px|||" custom_padding="16px|0px|5px|8px||" content__hover_enabled="off|desktop"]

By Dishang Patel, Fintech & Growth Delivery Partner, Leading Point Financial Markets.

The past six months have by no means been a time of status quo. During this period of uncertainty, standards have been questioned and new ‘norms’ have been formed.

A standout development has been the intensified focus on cloud-based services. Levels of adoption have varied, from those moving to cloud for the first time, to others making cloud their only form of storage and access, and with numerous ‘others’ in between.

One area affected adversely (for those who weren’t ready) but positively (for those who were) is software. ‘Old-school’ software vendors – whose multi-million-pound solutions were traditionally implemented on premise at financial institutions, whether as part of a pure ‘buy’ or broader ‘build’ approach – have worked hard to offer cloud-based services.

The broad shift to working from home (WFH) as a result of the Covid-19 pandemic has tested the end-user experience all the way from front to back offices in financial institutions. Security, ease of access and speed are all high on the agenda in the new world in which we find ourselves.

The digitisation journey

With workforces operating globally, it is difficult to guarantee uniform user experiences and be able to cater for a multitude of needs. To achieve success in this area and to ensure a seamless WFH experience, financial institutions have moved things up a level and worked as hard as software providers to offer cloud-based solutions.

All manner of financial institutions (trading firms, brokerages, asset managers, challenger banks) have been on a digitisation journey to make the online user experience more consistent and reliable.

Composable Enterprise is an approach that those who have worked in a front office environment within financial services may have come across and for many could be the way forward.

Composable Enterprise: the way forward

Digitisation can come in many forms: from robotic process automation (RPA), operational excellence, implementation of application-based solution, interoperability and electronification. Interoperability and electronification are two key components of this Composable Enterprise approach.

Interoperability – whether in terms of web services, applications, or both – is an approach that can create efficiencies on the desktop and deliver improved user experience. It has the potential to deliver business performance benefits, in terms of faster and better decision making with the ultimate potential to uncover previously untapped alpha. It also has two important environmental benefits:

1) Reducing energy spend;

2) Less need for old hardware to be disposed of, delivering the reduced environmental footprint that organisations desire.

Electronification, for most industry players, may represent the final step on the full digitisation journey. According to the Oxford English Dictionary, electronification is the “conversion to or adoption of an electronic mode of operation,” which translates to the front office having all the tools they need to do their jobs to the best of their ability.

The beauty of both interoperability and electronification is that they work just as well in a remote set up as they do in an office environment. This is because a good implementation of both results in maximising an organisation’s ability to use all the tools (trading platforms, market data feeds, CRMs, and so on) at their disposal without needing masses of physical infrastructure.

Because of the lower barriers (such as time and cost) of interoperability, financial institutions should start their digitisation journeys from this component and then embark on a larger and more complicated move to electronification.

Composable Enterprise is about firms being able to choose the best component needed for their business, allowing them to be more flexible and more open in order to adapt to new potential revenue opportunities. In these challenging times, it is no surprise that more and more financial institutions are adding Composable Enterprise as a key item on their spending agenda.

[/et_pb_text][/et_pb_column][et_pb_column type="1_2" _builder_version="4.4.8"][et_pb_text disabled_on="on|on|off" _builder_version="4.4.8" min_height="15px" custom_margin="452px||133px|||" custom_padding="8px||0px|||"]

"The broad shift to working from home as a result of the Covid-19 pandemic has tested the end-user experience all the way from front to back offices in financial institutions."

[/et_pb_text][et_pb_text disabled_on="on|on|off" _builder_version="4.4.8" min_height="15px" custom_margin="452px||133px|||" custom_padding="8px|||||"]

"It has the potential to deliver business performance benefits, in terms of faster and better decision making with the ultimate potential to uncover previously untapped alpha."

[/et_pb_text][et_pb_text disabled_on="on|on|off" _builder_version="4.4.8" min_height="15px" custom_margin="427px|||||" custom_padding="1px|||||"]

"The beauty of both interoperability and electronification is that they work just as well in a remote set up as they do in an office environment."

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built="1" _builder_version="3.22.3" animation_style="fade" locked="off"][et_pb_row _builder_version="3.25"][et_pb_column type="4_4" _builder_version="3.25" custom_padding="|||" custom_padding__hover="|||"][et_pb_team_member name="Dishang Patel" position="Fintech & Growth Delivery Partner" image_url="https://leadingpointfm.com/wp-content/uploads/2020/03/dishang.2e16d0ba.fill-400x400-1.jpg" _builder_version="4.4.8" link_option_url="mailto:dishang@leadingpoint.io" hover_enabled="0" admin_label="Person" title_text="dishang.2e16d0ba.fill-400x400"]

Responsible for delivering digital FS businesses.

Transforming delivery models for the scale up market.

[/et_pb_team_member][et_pb_text admin_label="Contact Us" module_class="txtblue" _builder_version="3.27.4" text_font="||||||||" link_font="||||||||" ul_font="||||||||" text_orientation="center"]

Contact Us

[/et_pb_text][et_pb_text admin_label="Form" _builder_version="3.27.4"][formidable id=2][/et_pb_text][et_pb_code admin_label="Social media icons" module_class="form" _builder_version="3.19.4" custom_margin="0px||0px" custom_padding="0px||0px"]

-

- Connect

[/et_pb_code][/et_pb_column][/et_pb_row][/et_pb_section]

Information Security in a New Digital Era

[et_pb_section fb_built="1" _builder_version="4.4.8" min_height="1084px" custom_margin="16px||-12px|||" custom_padding="0px||0px|||"][et_pb_row column_structure="2_3,1_3" _builder_version="3.25" custom_margin="-2px|auto||auto||" custom_padding="1px||3px|||"][et_pb_column type="2_3" _builder_version="3.25" custom_padding="|||" custom_padding__hover="|||"][et_pb_social_media_follow url_new_window="off" follow_button="on" admin_label="Social Media Follow" _builder_version="4.4.8" text_orientation="left" module_alignment="left" min_height="14px" custom_margin="1px||5px|0px|false|false" custom_padding="0px|0px|0px|0px|false|false" border_radii="on|1px|1px|1px|1px"][et_pb_social_media_follow_network social_network="linkedin" url="https://uk.linkedin.com/company/leadingpoint" _builder_version="4.4.8" background_color="#007bb6" follow_button="on" url_new_window="off"]linkedin[/et_pb_social_media_follow_network][/et_pb_social_media_follow][et_pb_image src="https://leadingpointfm.com/wp-content/uploads/2020/09/infosec.jpg" title_text="infosec" align_tablet="center" align_phone="" align_last_edited="on|desktop" admin_label="Image" _builder_version="4.4.8" locked="off"][/et_pb_image][/et_pb_column][et_pb_column type="1_3" _builder_version="3.25" custom_padding="|||" custom_padding__hover="|||"][/et_pb_column][/et_pb_row][et_pb_row column_structure="1_2,1_2" _builder_version="4.4.8"][et_pb_column type="1_2" _builder_version="4.4.8"][et_pb_text admin_label="Text" _builder_version="4.4.8" text_font="||||||||" text_font_size="14px" text_line_height="1.6em" header_font="||||||||" header_font_size="25px" width="100%" custom_margin="10px|-34px|-5px|||" custom_padding="16px|0px|5px|8px||" content__hover_enabled="off|desktop"]

Shifting priorities

The 2020’s pandemic, subsequent economic turmoil and related social phenomena has paved the way for much-needed global digital transformation and the prioritisation of digital strategies. The rise in digitisation across all businesses, however, has accelerated cyber risk exponentially. With cloud-based attacks rising by 630% between January and April 2020(1), organisations are now turning their focus on how to benefit from digitisation whilst maintaining sufficiently secure digital environments for their services and clients.

A global challenge

A new digital setup could easily jeopardise organisations’ cyber safety. With data becoming companies’ most valuable asset, hackers are getting creative with increasingly-sophisticated threats and phishing attacks. According to the 2019 Data Breach Investigation Report(2) by Verizon, 32% of all verified data breaches appeared to be phishing.

As data leaks are increasing (3,800 alone in 2019), so is the cyber skill shortage. According to the MIT Technology Review report(3), there will be 3.5 million unfulfilled cybersecurity jobs in 2021; a rise of 350%. As a result of Covid-19 and digitised home working, cybersecurity professionals are high in demand to fill the gaps organisations’

currently face.

The way forward

Although tackling InfoSec breaches in the rapidly-evolving digital innovation landscape is not easy, it is essential to keep it as an absolute priority. In our work with regulated sector firms in financial services, pharma and energy as well as with fintechs, we see consistent steps that underpin successful information security risk management. We have created a leaderboard of 10 discussion points for COOs, CIOs and CISOs to keep up with their information security needs:

- Information Security Standards

Understand information security standards like NIST, ISO 27001/2 and BIP 0116/7 and put in place processes and controls accordingly. These are good practices to keep a secure digital environment and are vital to include in your risk mitigation strategy. Preventing cyber attacks and data breaches is less costly and less resource-exhaustive than dealing with the damage caused by these attacks. There are serious repercussions of security breaches in terms of cost and reputational damage, yet organisations still only look at the issue after the event. Data shows that firms prefer to take a passive approach to tackle these issues instead of taking steps to prevent them in the first place.

- Managing security in cloud delivery models

2020 has seen a rise in the use of SaaS applications to support employee engagement, workflow management and communication. While cloud is still an area in its preliminary stages, cloud adoption is rapidly accelerating. But many firms have initiated cloud migration projects without a firm understanding and design for the future business, customer or end user flows. This is critical to ensuring a good security infrastructure in a multi-cloud operating environment. How does your firm keep up with the latest developments in Cloud Management?

- Operational resilience

70% of Operational Risk professionals say that their priorities and focus have changed as a result of Covid-19(4). With less than half of businesses testing their continuity and business-preparedness initiatives(5), Coronavirus served as an eye-opener in terms of revisiting these questions. Did your business continuity plan prove successful? If so, what was the key to its success? How do you define and measure operational resilience in your business? Cross-functional data sets are increasingly vital for informed risk management.

- Culture

Cyber risk is not just a technology problem; it is a people

problem. You cannot mitigate cyber risks with just technology;

embedding the right culture within your team is vital. How do you make sure a cyber-secure company culture is kept up in remote working environments? Does your company already have an information security training plan in place?

- Knowing what data is important

Data is expanding exponentially – you have to know what you need to protect. Only by defining important data, reducing the signal-to-data noise and aggregating multiple data points can organisations look to protect them. As a firm, what percentage of your data elements are defined with an owner and user access workflow?

- Speed of innovation means risk

The speed of innovation is often faster than the speed of safety. As technology and data adoption is rapidly changing, data protection has to keep up as well – there is little point in investing in technology until you really understand your risks and your exposure to those risks. This is increasingly true of new business-tech frameworks, including DLT, AI and Open Banking. When looking at DLT and AI based processes - how do you define the security and thresholds?

- Master the basics

80% of UK companies and startups are not Cyber Essentials ready, which shows that the fundamentals of data security are not being dealt with. Larger companies are rigid and not sufficiently agile – more demands are being placed on teams but without sufficient resources and skills development. Large companies cannot innovate if they are not given the freedom to actually adapt. What is the blocker in your firm?

- Collaborate with startups

Thousands of innovative startups tackling cyber security currently exist and many more will begin their growth journey over the next few years. Larger businesses need to be more open to collaborating with them to help speed up advancements in the cyber risk space.

- The right technology can play a key role in efficiency and speed

We see the emerging operating models for firms are open API based, and organisations need to stitch together many point solutions. Technology can help here if deployed correctly. For

instance, to join up multiple data, to provide transparency of

messages crossing in and out of systems, to execute and detect

information security processes and controls with 100x efficiency and speed. This will make a material difference in the new world of

financial services.

- Transparency of your supply chain

Supply chains are becoming more data-driven than ever with increased number of core operations and IT services being outsourced. Attackers are using weak supplier controls to compromise client networks and dispersed dependencies create increased reliance and risk exposure from entities outside of your direct control. How do you manage the current pressure points of your supplier relationships?

Next steps

Cyber risk (especially regarding data protection) is simultaneously a compliance problem (regulatory risk, legal risk etc.), an architecture problem (infrastructure, business continuity, etc.), and a business problem (reputational risk, loss of trust, ‘data poisoning’, competitor intelligence etc.). There are existing risk assessment frameworks for managing operational risk (example: ORMF) – why not plug in?

Getting the basics right, using industry standards, multi-cloud environments and transparency of supply chain are good places to start. These are all to do with holistic data risk management (HRM).

While all these individual issues pose problems on their own, they can be viewed through inter-relationships applying a holistic approach where a coordinated solution can be found to efficiently manage these issues as a whole. The solution lies in taking a more deliberate approach to cyber security and following this 4-step process:

IDENTIFY

ORGANISE

ASSIGN

RESOLVE

Find out more on Operational Resilience from Leading Point:

https://leadingpointfm.com/operational-resilience-data-infrastructure-and-aconsolidated-risk-view-is-pivotal-to-the-new-rules-on-operational-risk/#_edn2

Find out more on Data Kitchen, a Leading Point initiative:

https://leadingpointfm.com/the-data-kitchen-does-data-need-science/

(1) https://www.fintechnews.org/the-2020-cybersecurity-stats-you-need-to-know/

(2) https://www.techfunnel.com/information-technology/cyber-security-trends/

(5) https://securityintelligence.com/articles/these-cybersecurity-trends-could-get-a-boost-in-2020/

[/et_pb_text][/et_pb_column][et_pb_column type="1_2" _builder_version="4.4.8"][et_pb_text disabled_on="on|on|off" _builder_version="4.4.8" min_height="15px" custom_margin="452px||133px|||" custom_padding="8px|||||"]

"With data becoming companies’ most valuable asset, hackers are getting creative with increasingly-sophisticated threats and phishing attacks."

[/et_pb_text][et_pb_text disabled_on="on|on|off" _builder_version="4.4.8" min_height="15px" custom_margin="452px||133px|||" custom_padding="8px||0px|||"]

"Preventing cyber attacks and data breaches is less costly and less resource-exhaustive than dealing with the damage caused by these attacks."

[/et_pb_text][et_pb_text disabled_on="on|on|off" _builder_version="4.4.8" min_height="15px" custom_margin="427px|||||" custom_padding="1px|||||"]

"70% of Operational Risk professionals say that their priorities and focus have changed as a result of Covid-19."

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built="1" _builder_version="4.4.8"][et_pb_row column_structure="1_3,1_3,1_3" _builder_version="4.4.8" min_height="643px"][et_pb_column type="1_3" _builder_version="4.4.8"][et_pb_gallery gallery_ids="4011" show_title_and_caption="off" _builder_version="4.4.8" width="100%"][/et_pb_gallery][et_pb_text _builder_version="4.4.8" custom_margin="-82px|||||" custom_padding="0px|||||"]

Rajen Madan

Founder & CEO

rajen@leadingpoint.io

Delivering Digital FS businesses. Change leader with over 20 years’ experience in helping firms with efficiency, revenue and risk management challenges

[/et_pb_text][/et_pb_column][et_pb_column type="1_3" _builder_version="4.4.8"][et_pb_image src="https://leadingpointfm.com/wp-content/uploads/2020/09/Aliz-photo-colour-320x500-1.jpg" title_text="Aliz photo colour 320x500 (1)" _builder_version="4.4.8"][/et_pb_image][et_pb_text _builder_version="4.4.8"]

Aliz Gyenes

Leading Point

Data Innovation, InfoSec, Investment behaviour research Helping businesses understand and improve their data strategy via the Leading Point Data Innovation Index

[/et_pb_text][/et_pb_column][et_pb_column type="1_3" _builder_version="4.4.8"][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built="1" module_class="txtwhite" _builder_version="3.22.3" background_color="#23408f" custom_padding="||62px|||" locked="off"][et_pb_row _builder_version="4.4.8"][et_pb_column type="4_4" _builder_version="4.4.8"][et_pb_text _builder_version="4.4.8" text_text_color="#ffffff" text_font_size="15px" header_text_color="#ffffff"]

How Leading Point can help

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row column_structure="1_3,1_3,1_3" _builder_version="4.4.8"][et_pb_column type="1_3" _builder_version="4.4.8"][/et_pb_column][et_pb_column type="1_3" _builder_version="4.4.8"][/et_pb_column][et_pb_column type="1_3" _builder_version="4.4.8"][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built="1" _builder_version="4.4.8" animation_style="fade" locked="off"][et_pb_row _builder_version="3.25"][et_pb_column type="4_4" _builder_version="3.25" custom_padding="|||" custom_padding__hover="|||"][et_pb_text admin_label="Contact Us" module_class="txtblue" _builder_version="3.27.4" text_font="||||||||" link_font="||||||||" ul_font="||||||||" text_orientation="center"]

Contact Us

[/et_pb_text][et_pb_text admin_label="Form" _builder_version="3.27.4"][formidable id=2][/et_pb_text][et_pb_code admin_label="Social media icons" module_class="form" _builder_version="3.19.4" custom_margin="0px||0px" custom_padding="0px||0px"]

-

- Connect

[/et_pb_code][/et_pb_column][/et_pb_row][/et_pb_section]

Artificial Intelligence: The Solution to the ESG Data Gap?

The Power of ESG Data

It was Warren Buffett who said, “It takes twenty years to build a reputation and five minutes to ruin it” and that is the reality that all companies face on a daily basis. An effective set of ESG (Environment, Social & Governance) policies has never been more crucial. However, it is being hindered by difficulties surrounding the effective collection and communication of ESG data points, as well a lack of standardisation when it comes to reporting such data. As a result, the ESG space is being revolutionised by Artificial Intelligence, which can find, analyse and summarise this information.

There is increasing public and regulatory pressure on firms to ensure their policies are sustainable and on investors to take such policies into account when making investment decisions. The issue for investors is how to know which firms are good ESG performers and which are not. The majority of information dominating research and ESG indices comes from company-reported data. However, with little regulation surrounding this, responsible investors are plagued by unhelpful data gaps and “Greenwashing”. This is when a firm uses favourable data points and convoluted wording to appear more sustainable than they are in reality. They may even leave out data points that reflect badly on them. For example, firms such as Shell are accused of using the word ‘sustainable’ in their mission statement whilst providing little evidence to support their claims (1).

Could AI be the complete solution?

AI could be the key to help investors analyse the mountain of ESG data that is yet to be explored, both structured and unstructured. Historically, AI has been proven to successfully extract relevant information from data sources including news articles but it also offers new and exciting opportunities. Consider the transcripts of board meetings from a Korean firm: AI could be used to translate and examine such data using techniques such as Sentiment Analysis. Does the CEO seem passionate about ESG issues within the company? Are they worried about an investigation into Human Rights being undertaken against them? This is a task that would be labour-intensive, to say the least, for analysts to complete manually.

In addition, AI offers an opportunity for investors to not only act responsibly, but also align their ESG goals to a profitable agenda. For example, algorithms are being developed that can connect specific ESG indicators to financial performance and can therefore be used by firms to identify the risk and reward of certain investments.

Whilst AI offers numerous opportunities with regards to ESG investing, it is not without fault. Firstly, AI takes enormous amounts of computing power and, hence, energy. For example, in 2018, OpenAI found the level of computational power used to train the largest AI models has been doubling every 3.4 months since 2012 (2). With the majority of the world’s energy coming from non-renewable sources, it is not difficult to spot the contradiction in motives here. We must also consider whether AI is being used to its full potential; when simply used to scan company published data, AI could actually reinforce issues such as “Greenwashing”. Further, the issue of fake news and unreliable sources of information still plagues such methods and a lot of work has to go into ensuring these sources do not feature in algorithms used.

When speaking with Dr Thomas Kuh, Head of Index at leading ESG data and AI firm Truvalue Labs™, he outlined the difficulties surrounding AI but noted that since it enables human beings to make more intelligent decisions, it is surely worth having in the investment process. In fact, he described the application of AI to ESG research as ‘inevitable’ as long as it is used effectively to overcome the shortcomings of current research methods. For instance, he emphasised that AI offers real time information that traditional sources simply cannot compete with.

A Future for AI?

According to a 2018 survey from Greenwich Associates (3), only 17% of investment professionals currently use AI as part of their process; however, 40% of respondents stated they would increase budgets for AI in the future. As an area where investors are seemingly unsatisfied with traditional data sources, ESG is likely to see more than its fair share of this increase. Firms such as BNP Paribas (4) and Ecofi Investissements (5) are already exploring AI opportunities and many firms are following suit. We at Leading Point see AI inevitably becoming integral to an effective responsible investment process and intend to be at the heart of this revolution.

AI is by no means the judge, jury and executioner when it comes to ESG investing and depends on those behind it, constantly working to improve the algorithms, as well as the analysts using it to make more informed decisions. AI does, however, have the potential to revolutionise what a responsible investment means and help reallocate resources towards firms that will create a better future.

[1] The problem with corporate greenwashing

[2] AI and Compute

[3] Could AI Displace Investment Bank Research?

[4] How AI could shape the future of investment banking

[5] How AI Can Help Find ESG Opportunities

"It takes twenty years to build a reputation and five minutes to ruin it"

AI offers an opportunity for investors to not only act responsibly, but also align their ESG goals to a profitable agenda

Environmental Social Governance (ESG) & Sustainable Investment

Client propositions and products in data driven transformation in ESG and Sustainable Investing. Previous roles include J.P. Morgan, Morgan Stanley, and EY.

Upcoming blogs:

This is the second in a series of blogs that will explore the ESG world: its growth, its potential opportunities and the constraints that are holding it back. We will explore the increasing importance of ESG and how it affects business leaders, investors, asset managers, regulatory actors and more.

Riding the ESG Regulatory Wave: In the third part of our Environmental, Social and Governance (ESG) blog series, Alejandra explores the implementation challenges of ESG regulations hitting EU Asset Managers and Financial Institutions.

Is it time for VCs to take ESG seriously? In the fourth part of our Environmental, Social and Governance (ESG) blog series, Ben explores the current research on why startups should start implementing and communicating ESG policies at the core of their business.

Now more than ever, businesses are understanding the importance of having well-governed and socially-responsible practices in place. A clear understanding of your ESG metrics is pivotal in order to communicate your ESG strengths to investors, clients and potential employees.

By using our cloud-based data visualisation platform to bring together relevant metrics, we help organisations gain a standardised view and improve your ESG reporting and portfolio performance. Our live ESG dashboard can be used to scenario plan, map out ESG strategy and tell the ESG story to stakeholders.

AI helps with the process of ingesting, analysing and distributing data as well as offering predictive abilities and assessing trends in the ESG space. Leading Point is helping our AI startup partnerships adapt their technology to pursue this new opportunity, implementing these solutions into investment firms and supporting them with the use of the technology and data management.

We offer a specialised and personalised service based on firms’ ESG priorities. We harness the power of technology and AI to bridge the ESG data gap, avoiding ‘greenwashing’ data trends and providing a complete solution for organisations.

Leading Point's AI-implemented solutions decrease the time and effort needed to monitor current/past scandals of potential investments. Clients can see the benefits of increased output, improved KPIs and production of enhanced data outputs.

Implementing ESG regulations and providing operational support to improve ESG metrics for banks and other financial institutions. Ensuring compliance by benchmarking and disclosing ESG information, in-depth data collection to satisfy corporate reporting requirements, conducting appropriate investment and risk management decisions, and to make disclosures to clients and fund investors.

What if business operations could be more like Lego?

Financial services (FS) professionals from 30+ organisations tuned in to our inaugural webinar last week “What if business operations could be more like Lego?” to hear the challenges that COO and Heads of Change face in changing their business operating models and how we might break through the barriers. A summary of key takeaways from the discussion are presented below. See the webinar recording here

The importance of ‘Know Your Operating Model’

FS firms are under renewed pressure to rethink their operating models; competitive pressure, raised consumer expectations, and continuous regulatory requirements mean constant operating model re-think and change. Yet most firms are stuck with theoretical target operating models that lack a plan, a way to measure performance and progress, or a business case. As a result, only 25% of investors are confident strategic digital transformation will be effective.**

Innovation is hindered as firms struggle to overcome significant technical debt to implement new technology (e.g. automation, AI, cloud etc.) while effectively using budget tied up in high operating costs. Indeed, 80% of technology spend in organisations is focused on legacy systems and processes, while only 20% of analytics insights deliver business outcomes and 80% of AI projects “remain alchemy, run by wizards”***

Insufficient business understanding means lost opportunities, wasteful spends & risk – if you don’t understand your business well enough, you will be exposing yourself to risks and lost opportunities.

The barriers to business understanding

Firms current approaches to business operations and change are not fit for purpose.

Insight Gap in the Boardroom: Experts with specialist toolkits are needed to structure and interpret most business information. Management’s understanding of the business is often directly related to the ability of their analytical teams to explain it to them. Most firms are still stuck with an overload of information without insights, without the right questions being asked.

Cultural Challenge: Many execs still think in terms of headcount and empire building rather than outcomes, capabilities, and clients.

Misaligned metrics: Metrics are too focused on P&L, costs and bonuses! Less on holistic organisation metrics, proof points and stories.

Complexity makes it difficult to act… Most enterprises suffer from excessively complicated operating models where the complexity of systems, policies, processes, controls, data and their accompanying activities make it difficult to act.

…and difficult to explain: Substantiating decisions to stakeholders, regulators or investors is an ongoing struggle, for both new and historic decisions.

If you can't measure it, you can't manage it: Inconsistent change initiatives without performance metrics compound errors of the past and mean opportunities for efficiency gains go unseen.

How can we break through these barriers?

Business insight comes from context, data and measurement: How the building blocks of the business fit together and interact is essential to the ‘what’ and ‘how’ of change, and measurement is key to drive transparency and improved behaviours.

Operating model dashboards are essential: Effective executives either have extremely strong dashboards underpinning their decisions or have long standing experience at the firm across multiple functions and get to “know” their operating mode innately. This is a key gap in most firms. 50% of attendees chose improved metrics & accessibility of operating model perspectives as priority areas to invest in.

Less is more: Senior managers should not be looking at more than 200 data points to run and change their business. Focusing on the core and essential metrics is necessary to cut through the noise.

The operating model data exists, it should now be harvested: The data you need probably already exists in PowerPoint presentations, Excel spreadsheets and workflow tools. Firms have struggled to harvest this data historically and automate the gathering process. We demonstrated how operating model data can be collected and used to create insights for improved decision-making using the modellr platform.

Culture change is central: Culture was voted by attendees as the #1 area to invest in, in order to improve business decision-making. Organisational culture is a key barrier to operating model change. A culture that incentivises crossing business silos and transparency will create benefits across the enterprise.

Client-driven: Clients are driving firms to more real-time processing along with the capability to understand much more information. Approaches that combine human intelligence with machine intelligence are already feasible and moving into the mainstream.

Get comfortable with making decisions with near perfect information: Increasingly executives and firms need to get comfortable with “near perfect” information to make decisions, act and deliver rapid business benefits.

Future Topics of Interest

Regulatory Reassurance: Regulators continue to expect comprehensive, responsible and tangible governance and control from Senior Managers. How can firms keep up with their regulatory obligations in a clear and simple way?

Environmental, Social & Governance (ESG): An increasingly-popular subject, ESG considers the impact of businesses on the environment and society. ESG metrics are becoming more important for investors & regulators and firms are looking for consistent ways to measure performance and progress in ESG metrics.

Operating Model-as-a-Service: As well as managing business operations themselves, firms need to monitor the models that describe those operations; their current state, their target state and the roadmap between the two. Currently, this is often done with expensive PowerPoint presentations that are usually left in cupboards and ignored because they are not “live” documents. Metrics around the operating model can be captured and tracked in a dashboard.

Anti-Financial Crime (AFC): Money laundering, terrorist financing, fraud, sanctions, bribery & corruption; the list of ways to commit financial crime through FS firms grows by the day. How can firms track their AFC risk levels and control effectiveness to see where they need to strengthen?

Information Security: With the huge volume of data that firms now collect, process & store, there are more and more risks to keep that data secure and private. Regulations like GDPR can impose very large fines on firms that break those regulations. Industry standards, such ISO 27001, help improve standards around information security.

*,** Oliver Wyman, 2020, The State Of The Financial Services Industry

*** Gartner, 2019, Our Top Data and Analytics Predicts for 2019

Time to Reset?

We see the varnish from the old oil painting of government, enterprise, business and leadership fade a bit every day. 2020 has already shown us how interconnected our world has become - a true Butterfly Effect. Interconnectivity is not a bad thing. It is the fragility, the brittleness of modern economies that is cause for concern. I believe this is a result of critical imbalances we have allowed to build up, without questioning. Now as the varnish from the old oil painting comes off, we have a once in a decade opportunity to reset and tackle these imbalances. To make bold brush strokes.

Where can we start?

Big Government or Small?

Do we need a Big Government or Small? The term ‘Big Government’ here is not intended to be derogatory. We see national priorities and decisions that don’t match that of the city, the village, or the council. Great plans and budgets that don’t translate into change on the ground. Equally, in the face of this crisis, we see barriers breaking down. A C-19 COVID Symptom tracker app, which each of us can use, allows a judicious allocation of scarce testing and treatment resources at a national and grassroot level. The opportunity is to examine the flow from the national to the level of council. Provide transparency and allow engagement. If it doesn't exist it should be created. Direct channels for us citizens to highlight problems, propose solutions, be data-driven and monitor implementation. It is not a question of a big government versus small. It is one that works transparently that matters.

Public or Private Sector Enterprise?

A key debate going into 2020 was about which sector provides a better service, is more efficient with resources - private or public sector enterprise? Think about the NHS, Transport, Energy, Manufacturing, Financial Services, Agriculture, Technology and Utilities. Healthy arguments and examples are cited to show the merits of both public and private sector. I believe the public-private argument completely misses the point. Whether an enterprise provides a good service or poor, spends judiciously or not is not down to public or private sector. It is down to some key principles - how it is governed, how accountable is its team and partners, does it know what good service looks like and is it equipped to provide these services. Enterprises can be funded by either public or private sector resources. The opportunity ahead is in data and tech enabled service delivery models, going digital. And public-private collaboration funding models can ignite innovation and value added services. The key to provide good service is not public or private sector, it is to provide a good service!

Role of Business

Businesses are standing out in two ways in these times. Those that care about their employees and partners and are doing their bit to help their communities and those that pretend to. People will remember businesses that care. Those that don't, will fall out of favour. That most of our essential "front line" staff in the face of a pandemic are paid low/ minimum wages is cowardly. It shows the scale of imbalances we have allowed to build up and seem to be comfortable with. Colleagues in maintenance, cleaning, nursing, restaurant, retail, agriculture, driving, security, manufacturing and teaching professions amongst others need to be compensated fairly. The opportunity here is to go after skewed compensation models, unviable business models and poor productivity with vigour. The tax structures reportedly exploited by big tech and conglomerates are ripe for reform and become principle driven. Likewise business owners having billions and calling for government bailouts or larger profitable companies using furlough schemes to offload their responsibilities to the public should face the consequence. This is a failure of law and the will of successive governments. Let us get it right this time. Bashing businesses and entrepreneurs is not the answer. They are born from the risk-reward equation and are the lifeblood of any economy.

Lessons in Leadership

As much as it is tempting to draw leadership lessons from the current pandemic, they are unique to the situation and not a one size fits all. But I find the war analogy somewhat flawed. The chancellor of the exchequer, Rishi Sunak said “we will be judged by our capacity for compassion and individual acts of kindness” – does that sound like a war? If anything, the lesson for future leaders is to be that much more focused on ensuring their team’s wellbeing, ensuring they are equipped with relevant resources. Good leaders will understand the importance of the informal and the invisible stuff – collaboration, unconventional thinking, meaningful conversations and problem solving over formal organisation structures. The world we have to navigate in is increasingly unpredictable and non-linear, command and control team structures and top-down change will not work.

Everyday we are seeing concrete examples of what is working in business, government and leadership and what is not. We can allow 2020 to be one mired in tragedy, lost lives, lost livelihoods and failed businesses or we can seize the once in a decade opportunity to reset and create the government, the enterprise, the business and leaders that we want and have lacked for some time. This is within reach.

What steps do you think will help create better business, government and leaders?

Please feel free to comment and share. Keep well!

Change leader with over 20 years’ experience in helping financial markets with their toughest business challenges in data, operating model transformation in sales, CRM, Ops, Data, Finance & MI functions, and delivery of complex compliance, front-to-back technology implementations. Significant line experience. Former partner in management consulting leading client solution development, delivery and P&L incl. Accenture. Specialities – Operating Models, Data Assets, Compliance, Technology Partnerships & Solutions in Capital Markets, Market Infrastructure, Buy-Side, Banking & Insurance.

"2020 has already shown us how interconnected our world has become - a true Butterfly Effect."

"It is not a question of a big government versus small. It is one that works transparently that matters."

"Businesses are standing out in two ways in these times. Those that care about their employees and partners and are doing their bit to help their communities and those that pretend to."

"We can allow 2020 to be one mired in tragedy, lost lives, lost livelihoods and failed businesses or we can seize the once in a decade opportunity to reset and create the government, the enterprise, the business and leaders that we want and have lacked for some time"

Excel Ninjas & Digital Alchemists – Delivering success in Data Science in FS

In February 150+ data practitioners from financial institutions, FinTech, academia, and professional services joined the Leading Point Data Kitchen community and were keen to discuss the meaning and evolving role of Data Science within Financial Services. Many braved the cold wet weather and made it across for a highly productive session interspersed with good pizza and drinks.

Our expert panellists discussed the “wild” data environment in Financial Services inhabited by “Excel Ninjas”, “Data Wranglers” and “Digital Alchemists”. But agreed that despite the current state of the art being hindered by legacy infrastructure and data siloes there are a number of ways to find success.