AI Under Scrutiny

09/07/2024Investment Banking,Artificial Intelligence,Change Leadership,Data & Analytics,Risk Management,Insurance,StrategyArticle

Why AI risk & governance should be a focus area for financial services firms

Introduction

As financial services firms increasingly integrate artificial intelligence (AI) into their operations, the imperative to focus on AI risk & governance becomes paramount. AI offers transformative potential, driving innovation, enhancing customer experiences, and streamlining operations. However, with this potential comes significant risks that can undermine the stability, integrity, and reputation of financial institutions. This article delves into the critical importance of AI risk & governance for financial services firms, providing a detailed exploration of the associated risks, regulatory landscape, and practical steps for effective implementation. Our goal is to persuade financial services firms to prioritise AI governance to safeguard their operations and ensure regulatory compliance.

The Growing Role of AI in Financial Services

AI adoption in the financial services industry is accelerating, driven by its ability to analyse vast amounts of data, automate complex processes, and provide actionable insights. Financial institutions leverage AI for various applications, including fraud detection, credit scoring, risk management, customer service, and algorithmic trading. According to a report by McKinsey & Company, AI could potentially generate up to $1 trillion of additional value annually for the global banking sector.

Applications of AI in Financial Services

1 Fraud Detection and Prevention: AI algorithms analyse transaction patterns to identify and prevent fraudulent activities, reducing losses and enhancing security.

2 Credit Scoring and Risk Assessment: AI models evaluate creditworthiness by analysing non-traditional data sources, improving accuracy and inclusivity in lending decisions.

3 Customer Service and Chatbots: AI-powered chatbots and virtual assistants provide 24/7 customer support, while machine learning algorithms offer personalised product recommendations.

4 Personalised Financial Planning: AI-driven platforms offer tailored financial advice and investment strategies based on individual customer profiles, goals, and preferences, enhancing client engagement and satisfaction.

Potential Benefits of AI

The benefits of AI in financial services are manifold, including increased efficiency, cost savings, enhanced decision-making, and improved customer satisfaction. AI-driven automation reduces manual workloads, enabling employees to focus on higher-value tasks. Additionally, AI's ability to uncover hidden patterns in data leads to more informed and timely decisions, driving competitive advantage.

The Importance of AI Governance

AI governance encompasses the frameworks, policies, and practices that ensure the ethical, transparent, and accountable use of AI technologies. It is crucial for managing AI risks and maintaining stakeholder trust. Without robust governance, financial services firms risk facing adverse outcomes such as biased decision-making, regulatory penalties, reputational damage, and operational disruptions.

Key Components of AI Governance

1 Ethical Guidelines: Establishing ethical principles to guide AI development and deployment, ensuring fairness, accountability, and transparency.

2 Risk Management: Implementing processes to identify, assess, and mitigate AI-related risks, including bias, security vulnerabilities, and operational failures.

3 Regulatory Compliance: Ensuring adherence to relevant laws and regulations governing AI usage, such as data protection and automated decision-making.

4 Transparency and Accountability: Promoting transparency in AI decision-making processes and holding individuals and teams accountable for AI outcomes.

Risks of Neglecting AI Governance

Neglecting AI governance can lead to several significant risks:

1 Embedded bias: AI algorithms can unintentionally perpetuate biases if trained on biased data or if developers inadvertently incorporate them. This can lead to unfair treatment of certain groups and potential violations of fair lending laws.

2 Explainability and complexity: AI models can be highly complex, making it challenging to understand how they arrive at decisions. This lack of explainability raises concerns about transparency, accountability, and regulatory compliance

3 Cybersecurity: Increased reliance on AI systems raises cybersecurity concerns, as hackers may exploit vulnerabilities in AI algorithms or systems to gain unauthorised access to sensitive financial data

4 Data privacy: AI systems rely on vast amounts of data, raising privacy concerns related to the collection, storage, and use of personal information

5 Robustness: AI systems may not perform optimally in certain situations and are susceptible to errors. Adversarial attacks can compromise their reliability and trustworthiness

6 Impact on financial stability: Widespread adoption of AI in the financial sector can have implications for financial stability, potentially amplifying market dynamics and leading to increased volatility or systemic risks

7 Underlying data risks: AI models are only as good as the data that supports them. Incorrect or biased data can lead to inaccurate outputs and decisions

8 Ethical considerations: The potential displacement of certain roles due to AI automation raises ethical concerns about societal implications and firms' responsibilities to their employees

9 Regulatory compliance: As AI becomes more integral to financial services, there is an increasing need for transparency and regulatory explainability in AI decisions to maintain compliance with evolving standards

10 Model risk: The complexity and evolving nature of AI technologies mean that their strengths and weaknesses are not yet fully understood, potentially leading to unforeseen pitfalls in the future

To address these risks, financial institutions need to implement robust risk management frameworks, enhance data governance, develop AI-ready infrastructure, increase transparency, and stay updated on evolving regulations specific to AI in financial services.

The consequences of inadequate AI governance can be severe. Financial institutions that fail to implement proper risk management and governance frameworks may face significant financial penalties, reputational damage, and regulatory scrutiny. The proposed EU AI Act, for instance, outlines fines of up to €30 million or 6% of global annual turnover for non-compliance. Beyond regulatory consequences, poor AI governance can lead to biased decision-making, privacy breaches, and erosion of customer trust, all of which can have long-lasting impacts on a firm's operations and market position.

Regulatory Requirements

The regulatory landscape for AI in financial services is evolving rapidly, with regulators worldwide introducing guidelines and standards to ensure the responsible use of AI. Compliance with these regulations is not only a legal obligation but also a critical component of building a sustainable and trustworthy AI strategy.

Key Regulatory Frameworks

1 General Data Protection Regulation (GDPR): The European Union's GDPR imposes strict requirements on data processing and the use of automated decision-making systems, ensuring transparency and accountability.

2 Financial Conduct Authority (FCA): The FCA in the UK has issued guidance on AI and machine learning, emphasising the need for transparency, accountability, and risk management in AI applications.

3 Federal Reserve: The Federal Reserve in the US has provided supervisory guidance on model risk management, highlighting the importance of robust governance and oversight for AI models.

4 Monetary Authority of Singapore (MAS): MAS has introduced guidelines for the ethical use of AI and data analytics in financial services, promoting fairness, ethics, accountability, and transparency (FEAT).

5 EU AI Act: This new act aims to protect fundamental rights, democracy, the rule of law and environmental sustainability from high-risk AI, while boosting innovation and establishing Europe as a leader in the field. The regulation establishes obligations for AI based on its potential risks and level of impact.

Importance of Compliance

Compliance with regulatory requirements is essential for several reasons:

1 Legal Obligation: Financial services firms must adhere to laws and regulations governing AI usage to avoid legal penalties and fines.

2 Reputational Risk: Non-compliance can damage a firm's reputation, eroding trust with customers, investors, and regulators.

3 Operational Efficiency: Regulatory compliance ensures that AI systems are designed and operated according to best practices, enhancing efficiency and effectiveness.

4 Stakeholder Trust: Adhering to regulatory standards builds trust with stakeholders, demonstrating a commitment to responsible and ethical AI use.

Identifying AI Risks

AI technologies pose several specific risks to financial services firms that must be identified and mitigated through effective governance frameworks.

Bias and Discrimination

AI systems can reflect and reinforce biases present in training data, leading to discriminatory outcomes. For instance, biased credit scoring models may disadvantage certain demographic groups, resulting in unequal access to financial services. Addressing bias requires rigorous data governance practices, including diverse and representative training data, regular bias audits, and transparent decision-making processes.

Security Risks

AI systems are vulnerable to various security threats, including cyberattacks, data breaches, and adversarial manipulations. Cybercriminals can exploit vulnerabilities in AI models to manipulate outcomes or gain unauthorised access to sensitive financial data. Ensuring the security and integrity of AI systems involves implementing robust cybersecurity measures, regular security assessments, and incident response plans.

Operational Risks

AI-driven processes can fail or behave unpredictably under certain conditions, potentially disrupting critical financial services. For example, algorithmic trading systems can trigger market instability if not responsibly managed. Effective governance frameworks include comprehensive testing, continuous monitoring, and contingency planning to mitigate operational risks and ensure reliable AI performance.

Compliance Risks

Failure to adhere to regulatory requirements can result in significant fines, legal consequences, and reputational damage. AI systems must be designed and operated in compliance with relevant laws and regulations, such as data protection and automated decision-making guidelines. Regular compliance audits and updates to governance frameworks are essential to ensure ongoing regulatory adherence.

Benefits of Effective AI Governance

Implementing robust AI governance frameworks offers numerous benefits for financial services firms, enhancing risk management, trust, and operational efficiency.

Risk Mitigation

Effective AI governance helps identify, assess, and mitigate AI-related risks, reducing the likelihood of adverse outcomes. By implementing comprehensive risk management processes, firms can proactively address potential issues and ensure the safe and responsible use of AI technologies.

Enhanced Trust and Transparency

Transparent and accountable AI practices build trust with customers, regulators, and other stakeholders. Clear communication about AI decision-making processes, ethical guidelines, and risk management practices demonstrates a commitment to responsible AI use, fostering confidence and credibility.

Regulatory Compliance

Adhering to governance frameworks ensures compliance with current and future regulatory requirements, minimising legal and financial repercussions. Robust governance practices align AI development and deployment with regulatory standards, reducing the risk of non-compliance and associated penalties.

Operational Efficiency

Governance frameworks streamline the development and deployment of AI systems, promoting efficiency and consistency in AI-driven operations. Standardised processes, clear roles and responsibilities, and ongoing monitoring enhance the effectiveness and reliability of AI applications, driving operational excellence.

Case Studies

Several financial services firms have successfully implemented AI governance frameworks, demonstrating the tangible benefits of proactive risk management and responsible AI use.

JP Morgan Chase

JP Morgan Chase has established a comprehensive AI governance structure that includes an AI Ethics Board, regular audits, and robust risk assessment processes. The AI Ethics Board oversees the ethical implications of AI applications, ensuring alignment with the bank's values and regulatory requirements. Regular audits and risk assessments help identify and mitigate AI-related risks, enhancing the reliability and transparency of AI systems.

ING Group

ING Group has developed an AI governance framework that emphasises transparency, accountability, and ethical considerations. The framework includes guidelines for data usage, model validation, and ongoing monitoring, ensuring that AI applications align with the bank's values and regulatory requirements. By prioritising responsible AI use, ING has built trust with stakeholders and demonstrated a commitment to ethical and transparent AI practices.

HSBC

HSBC has implemented a robust AI governance framework that focuses on ethical AI development, risk management, and regulatory compliance. The bank's AI governance framework includes a dedicated AI Ethics Committee, comprehensive risk management processes, and regular compliance audits. These measures ensure that AI applications are developed and deployed responsibly, aligning with regulatory standards and ethical guidelines.

Practical Steps for Implementation

To develop and implement effective AI governance frameworks, financial services firms should consider the following actionable steps:

Establish a Governance Framework

Develop a comprehensive AI governance framework that includes policies, procedures, and roles and responsibilities for AI oversight. The framework should outline ethical guidelines, risk management processes, and compliance requirements, providing a clear roadmap for responsible AI use.

Create an AI Ethics Board

Form an AI Ethics Board or committee to oversee the ethical implications of AI applications and ensure alignment with organisational values and regulatory requirements. The board should include representatives from diverse departments, including legal, compliance, risk management, and technology.

Implement Specific AI Risk Management Processes

Conduct regular risk assessments to identify and mitigate AI-related risks. Implement robust monitoring and auditing processes to ensure ongoing compliance and performance. Risk management processes should include bias audits, security assessments, and contingency planning to address potential operational failures.

Ensure Data Quality and Integrity

Establish data governance practices to ensure the quality, accuracy, and integrity of data used in AI systems. Address potential biases in data collection and processing, and implement measures to maintain data security and privacy. Regular data audits and validation processes are essential to ensure reliable and unbiased AI outcomes.

Invest in Training and Awareness

Provide training and resources for employees to understand AI technologies, governance practices, and their roles in ensuring ethical and responsible AI use. Ongoing education and awareness programs help build a culture of responsible AI use, promoting adherence to governance frameworks and ethical guidelines.

Engage with Regulators and Industry Bodies

Stay informed about regulatory developments and industry best practices. Engage with regulators and industry bodies to contribute to the development of AI governance standards and ensure alignment with evolving regulatory requirements. Active participation in industry forums and collaborations helps stay ahead of regulatory changes and promotes responsible AI use.

Conclusion

As financial services firms continue to embrace AI, the importance of robust AI risk & governance frameworks cannot be overstated. By proactively addressing the risks associated with AI and implementing effective governance practices, firms can unlock the full potential of AI technologies while safeguarding their operations, maintaining regulatory compliance, and building trust with stakeholders. Prioritising AI risk & governance is not just a regulatory requirement but a strategic imperative for the sustainable and ethical use of AI in financial services.

References and Further Reading

- McKinsey & Company. (2020). The AI Bank of the Future: Can Banks Meet the AI Challenge?

- European Union. (2018). General Data Protection Regulation (GDPR).

- Financial Conduct Authority (FCA). (2019). Guidance on the Use of AI and Machine Learning in Financial Services.

- Federal Reserve. (2020). Supervisory Guidance on Model Risk Management.

- JP Morgan Chase. (2021). AI Ethics and Governance Framework.

- ING Group. (2021). Responsible AI: Our Approach to AI Governance.

- Monetary Authority of Singapore (MAS). (2019). FEAT Principles for the Use of AI and Data Analytics in Financial Services.

For further reading on AI governance and risk management in financial services, consider the following resources:

- "Artificial Intelligence: A Guide for Financial Services Firms" by Deloitte

- "Managing AI Risk in Financial Services" by PwC

- "AI Ethics and Governance: A Global Perspective" by the World Economic Forum

Strengthening Information Security

17/04/2024Corporate Banking,Risk Management,Data Governance,Investment Banking,Data & Analytics,Data Quality,Insurance,StrategyArticle

The Combined Power of Identity & Access Management and Data Access Controls

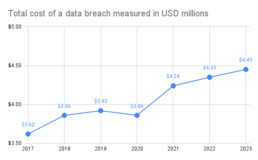

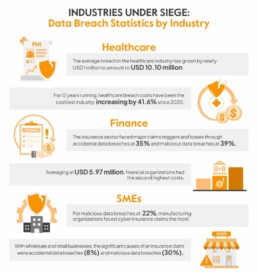

The digital age presents a double-edged sword for businesses. While technology advancements offer exciting capabilities in cloud, data analytics, and customer experience, they also introduce new security challenges. Data breaches are a constant threat, costing businesses an average of $4.45 million per incident according to a 2023 IBM report (https://www.ibm.com/reports/data-breach) and eroding consumer trust. Traditional security measures often fall short, leaving vulnerabilities for attackers to exploit. These attackers, targeting poorly managed identities and weak data protection, aim to disrupt operations, steal sensitive information, or even hold companies hostage. The impact extends beyond the business itself, damaging customers, stakeholders, and the broader financial market

In response to these evolving threats, the European Commission (EU) has implemented the Digital Operational Resilience Act (DORA) (Regulation (EU) 2022/2554). This regulation focuses on strengthening information and communications technology (ICT) resilience standards in the financial services sector. While designed for the EU, DORA’s requirements offer valuable insights for businesses globally, especially those with operations in the EU or the UK. DORA mandates that financial institutions define, approve, oversee, and be accountable for implementing a robust risk-management framework. This is where identity & access management (IAM) and data access controls (DAC).

The Threat Landscape and Importance of Data Security

Data breaches are just one piece of the security puzzle. Malicious entities also employ malware, phishing attacks, and even exploit human error to gain unauthorised access to sensitive data. Regulatory compliance further emphasises the importance of data security. Frameworks like GDPR and HIPAA mandate robust data protection measures. Failure to comply can result in hefty fines and reputational damage.

Organisations, in a rapidly-evolving hybrid working environment, urgently need to implement or review their information security strategy. This includes solutions that not only reduce the attack surface but also improve control over who accesses what data within the organisation. IAM and DAC, along with fine-grained access provisioning for various data formats, are critical components of a strong cybersecurity strategy.

Keep reading to learn the key differences between IAM and DAC, and how they work in tandem to create a strong security posture.

Identity & Access Management (IAM)

Think of IAM as the gatekeeper to your digital environment. It ensures only authorised users can access specific systems and resources. Here is a breakdown of its core components:

- Identity Management (authentication): This involves creating, managing, and authenticating user identities. IAM systems manage user provisioning (granting access), authentication (verifying user identity through methods like passwords or multi-factor authentication [MFA]), and authorisation (determining user permissions). Common identity management practices include:

- Single Sign-On (SSO): Users can access multiple applications with a single login, improving convenience and security.

- Multi-Factor Authentication (MFA):An extra layer of security requiring an additional verification factor beyond a password (e.g., fingerprint, security code).

- Passwordless: A recent usability improvement removes the use of passwords and replaces them with authentication apps and biometrics.

- Adaptive or Risk-based Authentication: Uses AI and machine learning to analyse user behaviour and adjust authentication requirements in real-time based on risk level.

- Access Management (authorisation): Once a user has had their identity authenticated, then access management checks to see what resources the user has access to. IAM systems apply tailored access policies based on user identities and other attributes. Once verified, IAM controls access to applications, data, and other resources.

Advanced IAM concepts like Privileged Access Management (PAM) focus on securing access for privileged users with high-level permissions, while Identity Governance ensures user access is reviewed and updated regularly.

Data Access Control (DAC)

While IAM focuses on user identities and overall system access, DAC takes a more granular approach, regulating access to specific data stored within those systems. Here are some common DAC models:

- Discretionary Access Control (also DAC): Allows data owners to manage access permissions for other users. While offering flexibility, it can lead to inconsistencies and security risks if not managed properly. One example of this is UNIX files, where an owner of a file can grant or deny other users access.

- Mandatory Access Control (MAC): Here, the system enforces access based on pre-defined security labels assigned to data and users. This offers stricter control but requires careful configuration.

- Role-Based Access Control (RBAC): This approach complements IAM RBAC by defining access permissions for specific data sets based on user roles.

- Attribute-Based Access Control (ABAC): Permissions are granted based on a combination of user attributes, data attributes, and environmental attributes, offering a more dynamic and contextual approach.

- Encryption: Data is rendered unreadable without the appropriate decryption key, adding another layer of protection.

IAM vs. DAC: Key Differences and Working Together

While IAM and DAC serve distinct purposes, they work in harmony to create a comprehensive security posture. Here is a table summarising the key differences:

FEATURE

IAM

DAC

Description

Controls access to applications

Controls access to data within applications

Granularity

Broader – manages access to entire systems

More fine-grained – controls access to specific data check user attributes

Enforcement

User-based (IAM) or system-based (MAC)

System-based enforcement (MAC) or user-based (DAC)

Imagine an employee accessing customer data in a CRM system. IAM verifies their identity and grants access to the CRM application. However, DAC determines what specific customer data they can view or modify based on their role (e.g., a sales representative might have access to contact information but not financial details).

Dispelling Common Myths

Several misconceptions surround IAM and DAC. Here is why they are not entirely accurate:

- Myth 1: IAM is all I need. The most common mistake that organisations make is to conflate IAM and DAC, or worse, assume that if they have IAM, that includes DAC. Here is a hint. It does not.

- Myth 2: IAM is only needed by large enterprises. Businesses of all sizes must use IAM to secure access to their applications and ensure compliance. Scalable IAM solutions are readily available.

- Myth 3: More IAM tools equal better security. A layered approach is crucial. Implementing too many overlapping IAM tools can create complexity and management overhead. Focus on choosing the right tools that complement each other and address specific security needs.

- Myth 4: Data access control is enough for complete security. While DAC plays a vital role, it is only one piece of the puzzle. Strong IAM practices ensure authorised users are accessing systems, while DAC manages their access to specific data within those systems. A comprehensive security strategy requires both.

Tools for Effective IAM and DAC

There are various IAM and DAC solutions available, and the best choice depends on your specific needs. While Active Directory remains a popular IAM solution for Windows-based environments, it may not be ideal for complex IT infrastructures or organisations managing vast numbers of users and data access needs.

Imagine a scenario where your application has 1,000 users and holds sensitive & personal customer information for 1,000,000 customers split across ten countries and five products. Not every user should see every customer record. It might be limited to the country the user works in and the specific product they support. This is the “Principle of Least Privilege.” Applying this principle is critical to demonstrating you have appropriate data access controls.

To control access to this data, you would need to create tens of thousands of AD groups for every combination of country or countries and product or products. This is unsustainable and makes choosing AD groups to manage data access control an extremely poor choice.

The complexity of managing nested AD groups and potential integration challenges with non-Windows systems highlight the importance of carefully evaluating your specific needs when choosing IAM tools. Consider exploring cloud-based IAM platforms or Identity Governance and Administration (IGA) solutions for centralised management and streamlined access control.

Building a Strong Security Strategy

The EU’s Digital Operational Resilience Act (DORA) emphasises strong IAM practices for financial institutions and will coming into act from 17 January 2025. DORA requires financial organisations to define, approve, oversee, and be accountable for implementing robust IAM and data access controls as part of their risk management framework.

Here are some key areas where IAM and DAC can help organisations comply with DORA and protect themselves:

DORA Pillar

How IAM helps

How DAC helps

ICT risk management

- Identifies risks associated with unauthorised access/misuse

- Detects users with excessive permissions or dormant accounts

- Minimises damage from breaches by restricting access to specific data

ICT related incident reporting

- Provides audit logs for investigating breaches (user activity, login attempts, accessed resources)

- Helps identify source of attack and compromised accounts

- Helps determine scope of breach and potentially affected information

ICT third-party risk management

- Manages access for third-party vendors/partners

- Grants temporary access with limited permissions, reducing attack surface

- Restricts access for third-party vendors by limiting ability to view/modify sensitive data

Information sharing

- Permissions designated users authorised to share sensitive information

- Controls access to shared information via roles and rules

Digital operational resilience testing

- Enables testing of IAM controls to identify vulnerabilities

- Penetration testing simulates attacks to assess effectiveness of IAM controls

- Ensures data access restrictions are properly enforced and minimizes breach impact

Understanding IAM and DAC empowers you to build a robust data security strategy

Use these strategies to leverage the benefits of IAM and DAC combined:

- Recognise the difference between IAM and DAC, and how they are implemented in your organisation

- Conduct regular IAM and DAC audits to identify and address vulnerabilities

- Implement best practices like the Principle of Least Privilege (granting users only the minimum access required for their job function)

- Regularly review and update user access permissions

- Educate employees on security best practices (e.g., password hygiene, phishing awareness)

Explore different IAM and DAC solutions based on your specific organisational needs and security posture. Remember, a layered approach that combines IAM, DAC, and other security measures like encryption creates the most effective defence against data breaches and unauthorised access.

Conclusion

By leveraging the combined power of IAM and DAC, you can ensure only the right people have access to the right data at the right time. This fosters trust with stakeholders, protects your reputation, and safeguards your valuable information assets.

Helping a leading insurance provider improve their data access controls

02/04/2024Data & Analytics,InsuranceCase Study

A global insurance provider had begun migrating their legacy on-premise applications to a new data lake. With a strategic reporting solution used, it was clear that report users had access to data that they did not need to have access to.

Previous studies had identified the gaps and it was time to push forward and deliver a solution. We were engaged to define the roles and data access control business rules to support Germany, as they had specific requirements around employee name visibility. A temporary solution had been implemented but a strategic solution that unmasked employee names to those who needed to see them, was required.

We developed the rules with support from the Claims business, the Data Protection Officer, and German Works Council. We designed and built a Power BI prototype to demonstrate the rules working using attribute-based access controls (ABAC).

This prototype and the business rules have led to a further engagement to implement the solution in a real report connected to the data lake.

Top 5 Trends for MLROs in 2024

28/03/2024Corporate Banking,Investment Banking,Risk Management,Insurance,StrategyArticle

Our Financial Crime Practice Lead, Kavita Harwani, recently attended the FRC Leadership Convention at the Celtic Manor, Newport, Wales. This gave us the opportunity to engage with senior leaders in the financial risk and compliance space on the latest best practices, upcoming technology advances, and practical insights.

Criminals are becoming increasingly sophisticated, driving MLROs to innovate their financial crime controls. There is never a quiet time for FRC professionals, but 2024 is proving to be exceptionally busy.

Our view on the top five trends that MLROs need to focus on is presented here.

Top 5 Trends

- Minimise costs by using technology to scan the regulatory horizon and identify impacts on your business

- Accelerating transaction monitoring & decisioning by applying AI & data analytics

- Optimising due diligence with a 360 view of the customers

- Improving operational efficiency by using machine learning to automate alert handling

- Reducing financial crime risk through training and communications programmes.

1. Regulatory Compliance and Adaptation

MLROs need to stay abreast of evolving regulatory frameworks and compliance requirements. With regulatory changes occurring frequently, MLROs must ensure their organisations are compliant with the latest anti-money laundering (AML) and counter-terrorist financing (CTF) regulations.

This involves scanning the regulatory horizon, updating policies, procedures, and systems to reflect regulatory updates and adapting swiftly to new compliance challenges.

2. Technology & Data Analytics

MLROs will increasingly leverage advanced technology and data analytics tools to enhance their AML capabilities.

Machine learning algorithms and predictive analytics can help identify suspicious activities more effectively, allowing MLROs to detect and prevent money laundering and financial crime quicker, at lower cost, and with higher accuracy rates.

MLROs must focus on implementing robust AML technologies and optimising data analytics strategies to improve risk detection and decision-making processes.

3. Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD)

MLROs should prioritise strengthening CDD processes to better understand their customers’ risk of committing financial crimes.

Enhanced due diligence is critical for high-risk customers, such as politically exposed persons (PEPs) and high net worth individuals (HNWIs).

MLROs should focus on enhancing risk-based approaches to CDD and EDD, leveraging technology and data analytics to streamline customer onboarding processes while maintaining compliance with regulatory requirements.

4. Transaction Monitoring and Suspicious Activity Reporting

MLROs will continue to refine transaction monitoring systems to effectively identify suspicious activities and generate accurate alerts for investigation.

MLROs should focus on optimising transaction monitoring rules and scenarios to reduce false positives and prioritise high-risk transactions for further review.

Enhanced collaboration with law enforcement agencies and financial intelligence units will be crucial for timely and accurate suspicious activity reporting. Cross-industry collaboration is an expanding route to quicker insights on bad actors and behaviours.

5. Training and Awareness Programmes

MLROs must invest in comprehensive training and awareness programs to educate employees on AML risks, obligations, and best practices.

Building a strong culture of compliance within the organisation is essential for effective AML risk management.

Additionally, MLROs must promote a proactive approach to AML compliance, encouraging employees to raise concerns and seek guidance when faced with potential AML risks.

Conclusion

The expanded use of technology and data is becoming more evident from our discussions. The latest, ever-accelerating, improvements in automation and AI has brought a new set of opportunities to transform legacy manual, people-heavy processes into streamlined, efficient, and effective anti-financial crime departments.

Leading Point has a specialist financial crime team and can help strengthen your operations and meet these challenges in 2024. Reach out to our practice lead Kavita Harwani on kavita@leadingpoint.io to discuss your needs further.

Improving data access controls at a global insurer

12/03/2024Data & Analytics,FinTech,Change Leadership,Risk Management,InsuranceTestimonials

"We approached Leading Point to support the enhancement of strategic data lake fine grained access controls capabilities. Their partnership approach working transversally across business and IT functions quickly surfaced root causes to be addressed as part of the improvement plan. Leading Point's approach to consulting services was particularly refreshing from a quality and cost stand point compared to some of the traditional players that we had consulted with before."

Head of Data Controls at Global Corporate Insurer

Helping a US broker-dealer manage its application estate using open source tools

11/03/2024Wealth Management,Risk Management,Strategy,Data & AnalyticsCase Study

Our client was a Fortune 500 US independent broker-dealer with over 17,500 financial advisors and over 1tn USD in advisory and brokerage assets. They had a large application estate with nearly 1,000 applications they had either developed, bought or acquired through mergers and takeovers. The applications were captured in ServiceNow CMDB but there was little knowledge around flows, owners, data, and batch jobs.

Additionally, the client also wanted to roll out a new data strategy. Part of this engagement with their business community was to educate and inform about the data strategy and its impact on their work.

We were asked to implement an open source enterprise architecture tool called Waltz. Waltz had been originally developed at Deutsche Bank and had recently been released as open source software under FINOS (Fintech Open Source Foundation). Waltz is not widely-known in financial services yet and we saw this as a great opportunity to demonstrate the benefits of using open source tools.

To support the data strategy rollout, the client asked if we could build a simple and clear internal website to show the new data strategy and data model. The data model would be navigable to drill-down into more detail and provide links to existing documentation.

Our approach:

With our extensive implementation experience, we put together a small, experienced, cross-border team to deploy and configure Waltz. We knew that understanding the client's data was key; what data was required, where was it, how good was its quality. Waltz uses data around:

- Organisational units - different structures depending on the viewpoint (business, technical)

- People - managerial hierarchies, roles, responsibilities

- Applications - owners, technologies, costs, licences, flows, batch jobs

- Data - hierarchies, entities, attributes, definitions, quality, owners, lineage

- Capabilities - owners, services, processes

- Change - initiatives, costs, impact

We split our work into a number of workstreams:

- Data readiness - understand what data they had, the sources, and the quality

- Data configuration - understand the relationships between the data and prepare it for Waltz

- Waltz implementation - understand the base open source version of Waltz with its limitations, gather the client requirements (like single-sign on and configurable data loaders), develop the features into Waltz, and deploy Waltz at the client

- Data strategy website - understand the audience, design website prototype options for client review, build an interactive React website for the rollout roadshows

The project was challenging because, as ever, the state of the data. There were multiple inconsistencies which hinders the use of tooling to bring order. We needed to identify those inconsistencies, see who should own them, and ensure they were resolved.

With the flexibility of an enterprise architecture tool, it was important to be clear around the specific problems we wanted to solve for the client. We identified 10+ potential use cases that we worked with the client to narrow down. Future extensions of the project enabled us to extend into these other use cases.

One such problem was around batch job documentation. The client had thousands of Word docs specifying batch jobs transferring data between internal and external applications. These documents were held in SharePoint, Confluence, and local drives. This made it difficult to find information about specific batch jobs if something went wrong, for example.

We used the applications captured in Waltz and linked them together. We developed a new data loader that could import Word docs and extract the batch job information automatically from them. This was used to populate Waltz and make this information searchable, reducing the time spent by Support teams to find out about failed jobs.

One common negative that is raised about similar applications is the effort involved to get data into the application. Waltz accelerates this by sending surveys out to crowd-source knowledge from across the organisation. We found this a great way of engaging with users and capturing their experience into Waltz.

Our results:

We were able to deploy an open source enterprise architecture tool on a client's AWS cloud within three months. This included adding new features, such as single sign-on, improving existing Waltz capabilities, like the data loaders, and defining the data standards to enable smooth data integrations with source systems.

Using Waltz showed the client the value of bringing together disparate knowledge from around the organisation into one place. It does expose data gaps, but we always see this as a benefit for the client, as any improvement in data quality yields improved business results.

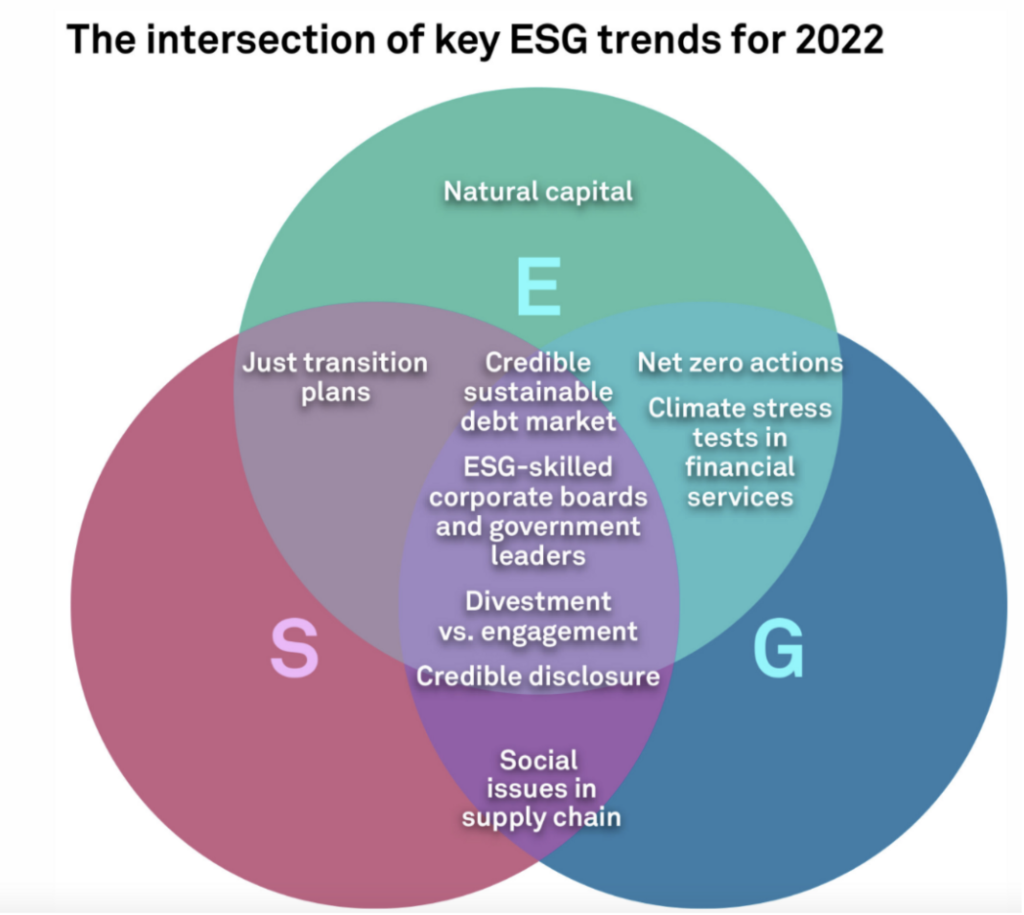

Helping a UK retail bank to benchmark their ESG progress against their peers

26/02/2024Data & Analytics,Corporate Banking,Risk ManagementCase Study

Our client wanted to improve their ESG position against their competitors, based on real data. They were unsure about where to start with ESG measurement and integrating ESG philosophy into their culture and business processes.

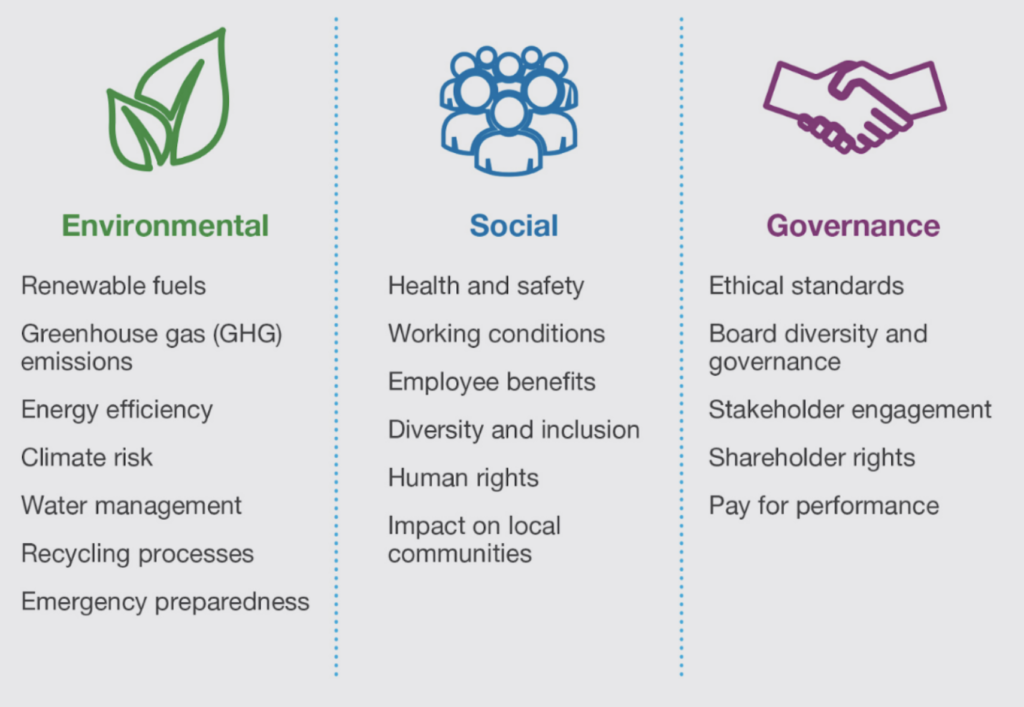

We were asked to come up with an ESG scoring model that could use existing public data from the client's peers against their own internal reporting data. This scoring model would be used to place the client against their peers in environmental, social, and governance groups, as well as an overall rating. Our ESG expertise was recognised in identifying which ESG frameworks could support this scoring model. We were also tasked with ensuring that their ESG philosophy was aligned to their purpose.

Our approach:

We used an example of best-in-class ESG stewardship in a Tier 1 financial services firm as a demonstration of what is possible. This case study covered how ESG impacted the firm across:

- Partnerships

- Products & services

- Diversity & inclusion

- Climate change

- Governance & ESG frameworks

We created an ESG scoring model that used existing ESG frameworks, such as SASB and UN SDGs. This scoring model included 32 questions across E, S and G categories. We researched public company reports to find data and references to key ESG themes. Thresholds were used to classify metrics and create a weighted score per category.

We emphasised the importance of authenticity in embedding ESG into a firm's culture. This was demonstrated through analysis of peer behaviour and assessing ESG integration into the peers' purpose. A set of recommendations were made to increase the maturity of ESG within the client, including specific frameworks and metrics to start tracking.

Our results:

The board members at the client were able to see where they stood versus their competitors, in more detail than ever before. This detail enabled a set of specific next steps to be laid out around establishing the ESG philosophy and policy of the client, which ESG areas to prioritise, changes to the risk appetite statement to incorporate ESG risks, and making a commitment to becoming net-zero.

Helping Adjoint gain ISO 27001 information security certification to support its expansion strategy

26/02/2024Data & Analytics,FinTech,Risk ManagementCase Study

Adjoint required ISO certification to comply with legislation, across multiple jurisdictions, and increase confidence in their brand. Due to the nature of their clients (fortune 500 and international companies), a widely recognised accreditation was required. The firm's incorporation of next generation processing, such as distributed ledger technology (DLT), increased the complexity to achieve certification. Their global teams in the UK, Switzerland and USA, were undergoing a heavy scaling-up.

We were asked to customise and implement an ISO 27001 framework for global accreditation in IT security management.

Our approach:

- Capture delivery requirements

- Create relevant policies, procedures and a controls framework, for applicable IT functions

- Perform gap analysis and risk assessment

- Establish clear roles and responsibilities and deliver a formal training program

- Conduct internal assurance audit to identify incidents and data breaches

- Lead external certification process with BSI, through Stage 1 and 2 completion

- Provide agile delivery through to completion

Our results:

- Effective coverage of all ISMS mandatory requirements surrounding ISO 27001

- A new performance management system to track controls in company processes, structure and focal points

- Global delivery, with clear road-mapping structure

- Scaled offerings in open APIs and raised brand in the market

- Improved sales process due to meeting client ISO requirements

Helping Adjoint, a DLT FinTech, with agile delivery management services to increase sales at pace

26/02/2024Change Leadership,FinTechCase Study

Adjoint required an experienced delivery partner to run technical delivery and build and manage client relationships, as well as create a scalable delivery model. They lacked a scalable platform and struggled to educate prospects and clients on the misconceptions between the benefits of DLT versus the noise created by other solutions.

We were asked to be the client and delivery partner, to deliver DLT solutions to fortune 50 clients, including tier 1 banks, insurers, and multinational corporations. The client wanted a scalable platform to manage internal and external work-streams, as well as internal and client resource prioritisation, to ensure better alignment of the product delivery team.

Our approach:

- Structured approach; using an Agile framework to deliver successful client PoCs and projects, whilst balancing PM, BA, Testing and DevOps deliverables

- Collaborative style; seamlessly adding capabilities and bringing delivery assets to the fore, through a low-risk delivery model, with a focus on outcomes

- Hands-on attitude; unravelling DLT, whilst enabling concrete application in treasury, captive insurance, inter-company lending, and securitisation, ensuring common messaging across clients

Our deliverables:

- Business requirements documents (BRDs)

- Testing artefacts

- Quick reference guides (QRGs)

- Support model

- Security policy

- Project plans

- Issue tracker

- Task management

Business benefits:

- Scalable, commercially attractive, and low-risk delivery model

- Optimisation of internal and external resource

- Market-ready DLT solutions with short term delivery timelines

- Recognised as an industry partner to work on value-add business use cases for DLT

- Senior stakeholder management (internal and external)

Helping a leading investment bank improve its client on-boarding processes into a single unified operating model

26/02/2024Investment Banking,Change LeadershipCase Study

Our client, like many banks, were facing multiple challenges in their onboarding and account opening processes. Scalability and efficiency were two important metrics we were asked to improve. Our senior experts interviewed the onboarding teams to document the current process and recommended a new unified process covering front, middle and back office teams.

We identified and removed key-person dependencies and documented the new process into a key operating manual for global use.

Helping Clarivate Analytics define a financial services (FS) go-to-market strategy for intellectual property data

26/02/2024Strategy,FinTech,Data & AnalyticsCase Study

We were asked by Clarivate to analyse their IP data and identify where it might be useful in financial services, based on our industry experience. We created and reviewed 39 use cases, interviewed 59 financial services specialists, and reviewed 150 potential partner companies.

We developed four value propositions and recommended 16 projects to execute the strategy.

Helping a global investment bank design & execute a client data governance target operating model

26/02/2024Change Leadership,Data & Analytics,Strategy,Investment BankingCase Study

Our client had a challenge to evidence control of their 2000+ client data elements. We were asked to implement a new target operating model for client data governance in six months. Our approach was to identify the core, essential data elements used by the most critical business processes and start governance for these, including data ownership and data quality.

We delivered business capability models, data governance processes, data quality rules & reporting, global support coverage for 100+ critical data elements supporting regulatory reporting and risk.

Helping a global investment bank reduce its residual risk with a target operating model

26/02/2024Risk Management,Change Leadership,Data & Analytics,Strategy,Investment BankingCase Study

Our client asked us to provide operating model design & governance expertise for its anti-financial crime (AFC) controls. We reviewed and approved the bank’s AFC target operating model using our structured approach, ensuring designs were compliant with regulations, aligned to strategy, and delivered measurable outcomes.

We delivered clear designs with capability impact maps, process models, and system & data architecture diagrams, enabling change teams to execute the AFC strategy.

Helping ARX, a cyber-security FinTech with interim COO services to scale-up their delivery

26/02/2024Strategy,Artificial Intelligence,FinTech,Change LeadershipCase Study

We were engaged by ARX to provide an interim COO as they gaining traction in the market and needed to scale their operations to support their new clients. We used our financial services delivery experience to take on UX/UI design, redesign their operational processes for scale, and be a delivery partner for their supply chain resilience solution.

Due to our efforts, ARX were able to meet their client demand with an improved product and more efficient sales & go-to-market approach.

Helping Bloomberg improve its data offering for its customers

26/02/2024Data Providers,Data & AnalyticsCase Study

Bloomberg wanted us to help review and refresh their 80,000 data terms in order to build a clear ontology of related information. We identified & prioritised the core, essential terms and designed new business rules for the data relationships. By creating a system-based approach, we could train the Bloomberg team to continue our work as BAU.

We improved the definitions, domains, and ranges to align with new ontologies, enabling their 300,000 financial services professionals to make more informed investment decisions.

Helping a Japanese investment bank to develop & execute their trading front-to-bank operating model

26/02/2024Investment Banking,Change LeadershipCase Study

Our client wanted to increase their trading efficiency by improving their data sourcing processes and resource efficiency in a multi-year programme. We analysed over 3,500 data feeds from 50 front office systems and over 100 reconciliations to determine how best to optimise their data.

Streamlining their data usage and operational processes is estimated to save them 20-30% costs over the next five years.

Helping a global consultancy define & execute its UK FinTech Strategy

26/02/2024Strategy,FinTechCase Study

Our client had developed 39 FinTech value propositions and we were asked to assess the propositions and prioritise when, and how, to go to market. We used our financial services experience and FinTech network to plan the best approach, through outreach, warm introductions, and events.

Our approach led to successful introductions with new prospect FinTechs in payments, neo-banks, and crypto firms within four months.

Helping GLEIF build out a new ISO standard for official organisational roles (ISO 5009)

26/02/2024Data Providers,Data & AnalyticsCase Study

GLEIF engaged us as financial services data experts to identify, analyse, and recommend relevant organisational roles for in-scope jurisdictions based on publicly-available laws & regulations. We looked at 12 locations in a four-week proof-of-concept, using automated document processing

Our work helped GLEIF to launch the ISO 5009 in 2022, enabling B2B verified digital signatures for individuals working in official roles. This digital verification speeds up onboarding time and increases trust.

Improving a DLT FinTech's operations enabling rapid scaling in target markets

25/02/2024Corporate Banking,FinTech,Investment Banking,Risk Management,Change LeadershipTestimonials

"Leading Point brings a top-flight management team, a reputation for quality and professionalism, and will heighten the value of [our] applications through its extensive knowledge of operations in the financial services sector."

Chief Risk Officer at DLT FinTech

Developing a GTM strategy at a large alternative data provider to break into new financial services markets

25/02/2024Data Providers,FinTech,Wealth Management,StrategyTestimonials

"Leading Point’s delivery has been head and shoulders above any other consultancy I have ever worked with."

SVP Large Alternative Data Provider

Increasing data product offerings by profiling 80k terms at a global data provider

25/02/2024Corporate Banking,Artificial Intelligence,Change Leadership,Wealth Management,Data & Analytics,Data Providers,Investment BankingTestimonials

“Through domain & technical expertise Leading Point have been instrumental in the success of this project to analyse and remediate 80k industry terms. LP have developed a sustainable process, backed up by technical tools, allowing the client to continue making progress well into the future. I would have no hesitation recommending LP as a delivery partner to any firm who needs help untangling their data.”

PM at Global Market Data Provider

Catch the Multi-Cloud Wave

25/01/2024Strategy,Investment Banking,Corporate Banking,Multi-Cloud,Change Leadership,Wealth Management,Insurance,CloudArticle

Charting Your Course

The digital realm is a constant current, pulling businesses towards new horizons. Today, one of the most significant tides shaping the landscape is the surge of multi-cloud adoption. But what exactly is driving this trend, and is your organisation prepared to ride the wave?

At its core, multi-cloud empowers businesses to break free from the constraints of a single cloud provider. Imagine cherry-picking the best services from different cloud vendors, like selecting the perfect teammates for a sailing crew. In 2022, 92% of firms either had or were considering a multi-cloud strategy (1). Having a strategy is one thing. Implementing it is a very different story. It takes meticulous planning and preparation. The potential of migrating from a single cloud provider to a multi-cloud environment can be huge if you are dealing with vast volumes of data. This flexibility unlocks a treasure trove of benefits.

1 Faction - The Continued Growth of Multi-Cloud and Hybrid Infrastructure

Top 4 Benefits

1 Unmatched Agility

Respond to ever-changing demands with ease by scaling resources up or down. Multi-cloud lets you ditch the "one-size-fits-all" approach and tailor your cloud strategy to your specific needs, fostering innovation and efficiency

2 Resilience in the Face of the Storm

Don't let cloud downtime disrupt your operations. By distributing your workload across multiple providers, you create a safety net that ensures uninterrupted service even when one encounters an issue.

3 A World of Choice at Your Fingertips

No single cloud provider can be all things to all businesses. Multi-cloud empowers you to leverage the unique strengths of different vendors, giving you access to a diverse array of services and optimising your overall offering.

4 Future-Proofing Your Digital Journey

The tech landscape is a whirlwind of innovation. With multi-cloud, you're not tethered to a single provider's roadmap. Instead, you have the freedom to seamlessly adapt to emerging technologies and trends, ensuring you stay ahead of the curve.

Cost Meets the Cloud

Perhaps the most exciting development propelling multi-cloud adoption is the shrinking cost barrier. As cloud providers engage in fierce competition, prices are driving down, making multi-cloud solutions more accessible for businesses of all sizes. This cost optimisation, coupled with the strategic advantages mentioned earlier, makes multi-cloud an increasingly attractive proposition. However, a word of caution: While the overall trend is towards affordability, navigating the multi-cloud landscape still requires meticulous planning and cost management. Without proper controls and precise resource allocation, you risk increased expenses and potential setbacks. With increased distribution of data, comes the increased risk of data leakage. Not only must data be protected within each cloud environment, it needs to be protected across the multi-cloud. Data monitoring increases in complexity. As data needs to move between cloud solutions, there may be additional latency risks. These can be mitigated with good risk controls and monitoring.

Kicking Off Your Journey

Ditch single-provider limitations and enjoy flexibility, resilience, and a wider range of services to boost your digital transformation but remember…

Multi-cloud environments can heighten security risks.

Navigate cautiously with proper controls and expert guidance to avoid hidden expenses.

Fierce competition is lowering multi-cloud barriers.

Let Leading Point be your guide, helping you set sail on the multi-cloud journey with confidence and unlock its full potential.

The multi-cloud path isn't without its challenges, but the rewards are undeniable. At Leading Point, we're experts in helping businesses navigate the multi-cloud wave with confidence. Let us help you unlock the full potential of multi-cloud for a more resilient, flexible, and innovative future. So, is your organisation ready to catch the wave? Contact Leading Point today and start your multi-cloud journey!

AI in Insurance - Article 1 - A Catalyst for Innovation

20/12/2023Data & Analytics,Datatomic Ventures,Insurance,Change Leadership,Artificial Intelligence,Data Providers,FinTechArticle

How insurance companies can use the latest AI developments to innovate their operations

The emergence of AI

The insurance industry is undergoing a profound transformation driven by the relentless advance of artificial intelligence (AI) and other disruptive technologies. A significant change in business thinking is gaining pace and Applied AI is being recognised for its potential in driving top-line growth and not merely a cost-cutting tool.

The adoption of AI is poised to reshape the insurance industry, enhancing operational efficiencies, improving decision-making, anticipating challenges, delivering innovative solutions, and transforming customer experiences.

This shift from data-driven to AI-driven operations is bringing about a paradigm shift in how insurance companies collect, analyse, and utilise data to make informed decisions and enhance customer experiences. By analysing vast amounts of data, including historical claims records, market forces, and external factors (global events like hurricanes, and regional conflicts), AI can assess risk with speed and accuracy to provide insurance companies a view of their state of play in the market.

Data vs AI approaches

This data-driven approach has enabled insurance companies to improve their underwriting accuracy, optimise pricing models, and tailor products to specific customer needs. However, the limitations of traditional data analytics methods have become increasingly apparent in recent years.

These methods often struggle to capture the complex relationships and hidden patterns within large datasets. They are also slow to adapt to rapidly-changing market conditions and emerging risks. As a result, insurance companies are increasingly turning to AI to unlock the full potential of their data and drive innovation across the industry.

AI algorithms, powered by machine learning and deep learning techniques, can process vast amounts of data far more efficiently and accurately than traditional methods. They can connect disparate datasets, identify subtle patterns, correlations & anomalies that would be difficult or impossible to detect with human analysis.

By leveraging AI, insurance companies can gain deeper insights into customer behaviour, risk factors, and market trends. This enables them to make more informed decisions about underwriting, pricing, product development, and customer service and gain a competitive edge in the ever-evolving marketplace.

Top 5 opportunities

1. Enhanced Risk Assessment

AI algorithms can analyse a broader range of data sources, including social media posts and weather patterns, to provide more accurate risk assessments. This can lead to better pricing and reduced losses.

2. Personalised Customer Experiences

AI can create personalised customer experiences, from tailored product recommendations to proactive risk mitigation guidance. This can boost customer satisfaction and loyalty.

3. Automated Claims Processing

AI can automate routine claims processing tasks, for example, by reviewing claims documentation and providing investigation recommendations, thus reducing manual efforts and improving efficiency. This can lead to faster claims settlements and lower operating costs.

4. Fraud Detection and Prevention

AI algorithms can identify anomalies and patterns in claims data to detect and prevent fraudulent activities. This can protect insurance companies from financial losses and reputational damage.

5. Predictive Analytics

AI can be used to anticipate future events, such as customer churn or potential fraud. This enables insurance companies to take proactive measures to prevent negative outcomes.

Adopting AI in Insurance

The adoption of AI in the insurance industry is not without its challenges. Insurance companies must address concerns about data quality, data privacy, transparency, and potential biases in AI algorithms. They must also ensure that AI is integrated seamlessly into their existing systems and processes.

Despite these challenges, AI presents immense opportunities. Insurance companies that embrace AI-driven operations will be well-positioned to gain a competitive edge, enhance customer experiences, and navigate the ever-changing risk landscape.

The shift from data-driven to AI-driven operations is a transformative force in the insurance industry. AI is not just a tool for analysing data; it is a catalyst for innovation and a driver of change. Insurance companies that harness the power of AI will be at the forefront of this transformation, shaping the future of insurance and delivering exceptional value to their customers.

Download the PDF article here.

The Consumer Duty Regulation

09/03/2023Consumer Duty,Wealth Management,Insurance,Regulation,Strategy,Risk Management,FinTechArticle

Improving outcomes with the Consumer Duty Regulation

How can buy-side retail financial firms improve consumer outcomes and the wider economy?

The FCA introduced new guidelines, rules and policies last year in 2022, comprised as the Consumer Duty Regulation, to ensure products and services are delivered at fair value to customers, as well as a better standard of care. With the recent rise of the cost-of-living crisis, consumers are struggling and are faced with difficult times ahead, including the UK economy. This Duty lays out responsibilities for Boards and senior management within firms, to implement this regulation, to not only benefit consumers, but the wider economy.

In a recent review published by the FCA in January 2023, the FCA identified key areas where firms are meeting obligations, and where areas of improvement are required. As stated in the Policy Statement PS22/9, the FCA would like to see firms make full use of the implementation period of this three-year strategy, to implement the Duty effectively, and that by October 2022, ‘firm’s boards (or equivalent management body) should have agreed their plans for implementing the Duty’ and to have evidenced this, to ‘challenge their plans to ensure they are deliverable and robust’ (Consumer Duty Implementation Plans, FCA, Jan 2023).

This review published by the FCA, helps firms understand the FCA’s expectations, and to work together with firms to ensure the Duty is implemented effectively. The review identified that firms are behind with the implementation of the Duty and need to improve their approach. Three key areas were suggested where firms can focus on for the second half of the implementation period, the first being ‘effective prioritisation of the Duty’ – in order to reduce risk of poor customer outcomes, and to prioritise the implementation plans. The second ‘embedding substantive requirements’, on how firms are over-confident on their plans, and instead should focus on the substantive requirements laid out in the Duty, and review ‘their products and services, communications and customer journeys, they identify and make the changes needed to meet the new standards’ (Consumer Duty Implementation Plans, FCA, Jan 2023). The third area of focus identified was on how firms should work together with other firms, to share information in the distribution chain, to ensure the Duty can be implemented effectively and consistently (Consumer Duty Implementation Plans, FCA, Jan 2023).

What can retail financial firms do to improve and what are the implications of not meeting the Duty requirements?

From the FCA’s recent review, it has been determined there are still many areas by which firms are falling short, which raises the risks of not meeting the Duty obligation deadlines. From the governance aspect, the FCA’s review has established that the board members and senior management teams within firms, have no clearly defined and developed plans in place, neither timings, and lack engagement. When it comes to the plans compiled by firms, the project requirements and timelines are unclear, there is a lack of detail, explanation, and evidence on the implementation of the Duty, including how a firm’s purpose, culture and values are in alignment with the Duty.

Additionally, the review identified that firms also fail to define risks, and internal/external dependencies such as resource planning, budgeting, and technology resources, including working together with third parties, which as a result may impact the implementation plans. Further, firms fail to distinguish mitigation strategies and approaches or methodologies for conducting reviews and gap analysis of products, services, communications, and customer journeys, as part of implementation of the Four Outcomes within the Duty. Firms have also failed to provide in-depth details into the types of data they will require, and how this will be tested, and used, to better understand the customer outcomes, which is another key part of the Duty requirements.

How can Leading Point help to simplify this process?

At Leading Point, our team of expert practitioners can assist the board members and senior managers within retail financial firms, to conduct more in-depth project scope and planning, gap analysis, as well as workflow strategies, and assist to define clear methodologies and approaches to implement the Duty policies and rules. We are fully-equipped to help any organisation that is looking to improve their implementation plans for meeting the Consumer Regulations, to ensure deadlines are met, whilst reducing costs, and risks, with defined mitigation strategies, and enhanced quality of consumer data. This will not only better equip firms with meeting the Duty obligations, but will help to accelerate new business growth, to ensure high-quality products and services are delivered to consumers.

Appendix and Additional Information on the Duty Regulation

What is the Consumer Duty Regulation?

The FCA introduced the Consumer Duty Regulation, and published the Finalised Guidelines FG22/5, along with the Policy Statement PS22/9 in July 2022, which is a ‘standard of care firms should give to customers in retail financial markets’ (FG22/9, p.3).

The FCA states that the purpose of the Consumer Duty (‘the Duty’) is to provide ‘a fairer basis for competition’, to help ‘boost growth and innovation’ (What firms and customers can expect from the consumer duty and other regulatory reforms, FCA (Sept, 2022)).

The Duty is comprised of three key areas: A Consumer Principle; the Cross-Cutting Rules; and the Four Outcomes (FG22/9, p.3). Each of these three key areas focus on how firms should deliver suitable products and services, as well as good outcomes to consumers.

Which firms and who will it impact?

The FG22/5 Guidelines state that the Duty applies ‘across retail financial services’, and that ‘firms should review all examples in this guidance and consider how they may be relevant to their business models and practices’ (FG22/5).

As stated in the FG22/5 Guidance, it is the firms responsibility to identify which rules and principles are applicable to their firm, and ‘what they are required to do’ (FG22/5).

What is the timeline of this Regulation?

It has been proposed for the Duty to be enforced in two-phase implementation periods, the first being by the end of July 2023, whereby the Duty will apply to new and existing products and services that remain for sale or open for renewal, and the second date is by July 2024, whereby the Duty will come fully into force, and will apply to all closed products and services (PS22/9).

The following timeline has been extracted from the Policy Statement – Implementation Timetable (PS22/9):

Implementation Period | Timeline |

Firms’ boards (or equivalent management body) should have agreed their implementation plans and be able to evidence they have scrutinised and challenged the plans to ensure they are deliverable and robust to meet the new standards. Firms should expect to be asked to share implementation plans, board papers and minutes with supervisors and be challenged on their contents. | End of October 2022 |

Manufacturers should aim to complete all the reviews necessary to meet the four outcome rules for their existing open products and services by the end of April 2023, so that they can:

• Share with distributors by the end of April 2023 the information necessary for them to meet their obligations under the Duty (e.g., in relation to the price and value, and products and service outcomes)

| End of April 2023 |

Manufacturers should: • Identify where changes need to be made to their existing open products and services to meet the Duty and implement these remedies by the end of July 2023 | End of July 2023 |

The Duty will apply to all new products and services, and all existing products and services that remain on sale or open for renewal. This gives firms 12 months to implement the new requirements on the bulk of retail financial products and services, benefiting the majority of consumers | End of July 2023 |

The Duty will come fully into force and apply to all closed products and services. This extra 12 months will help those firms with large numbers of closed products and will also help mitigate some of the wider concerns firms raised about the difficulty of applying the Duty to these products (see Chapter 3). | End of July 2024 |

How should firms implement the Consumer Duty Regulation?

According to the Guidance (FG22/5), it is a firm’s responsibility to identify which policies and rules apply and what they will be required to do (FG22/5). In addition to this, the Guidance has dedicated Chapter 10, on the Culture, Governance and Accountability that the Duty sets out for firms to give their customers. This is so that firms shift their focus on customer outcomes, and to ‘review the outcomes of their customers to ensure they are consistent with the Duty’ (PS22/9).

The Guidance (FG22/5) states the following:

- The rules require firms to ensure their strategies, governance, leadership, and people policies (including incentives at all levels) lead to good outcomes for customers. The rules also make clear that we expect customer outcomes to be a key lens for important areas, such as Risk and Internal Audit.

- A firm’s board, or equivalent governing body, should review and approve an assessment of whether the firm is delivering good outcomes for its customers which are consistent with the Duty, at least annually.

- Individual accountability and high standards of personal conduct in firms will ensure that firms are meeting their obligations under the Duty.

The Guidance (FG22/5) outlines four important drivers of culture that firms will need to ensure they deliver on from: Purpose; Leadership; People; and Governance. The Duty will also hold senior managers accountable via the Senior Managers & Certification Regime (SMCR) (FG22/5). A firm’s board will be responsible for the submission of a Board Report, which will be comprised of an assessment of whether the ‘firm is delivering good outcomes for its customers which are consistent with the Duty’ (FG22/5). Firms will also be required to monitor their outcomes, with a key focus of the Duty requiring firms to ‘assess, test, and understand’ and be able ‘to evidence the outcomes their customers are receiving’ (FG22/5), thus firms will be required to identify relevant sources of their data, to ensure they are consistent with meeting the obligations of the Duty, to their customers.

Unlocking the opportunity of vLEIs

08/02/2023LEI,Change Leadership,Wealth Management,Insurance,Data & Analytics,vLEI,Risk Management,Strategy,Investment Banking,FinTech,Corporate Banking,Data ProvidersArticle

Streamlining financial services workflows with Verifiable Legal Entity Identifiers (vLEIs)

Source: GLIEF

Trust is hard to come by

How do you trust people you have never met in businesses you have never dealt with before? It was difficult 20 years ago and even more so today. Many checks are needed to verify if the person you are talking to is the person you think it is. Do they even work for the business they claim to represent? Failures of these checks manifest themselves every day with spear phishing incidents hitting the headlines, where an unsuspecting clerk is badgered into making a payment to a criminal’s account by a person claiming to be a senior manager.

With businesses increasing their cross-border business and more remote working, it is getting harder and harder to trust what you see in front of you. How do financial services firms reduce the risk of cybercrime attacks? At a corporate level, there are Legal Entity Identifiers (LEIs) which have been a requirement for regulated financial services businesses to operate in capital markets, OTC derivatives, fund administration or debt issuance.

LEIs are issued by Local Operating Units (LOUs). These are bodies that are accredited by GLEIF (Global Legal Entity Identifier Foundation) to issue LEIs. Examples of LOUs are the London Stock Exchange Group (LSEG) and Bloomberg. However, LEIs only work at a legal entity level for an organisation. LEIs are not used for individuals within organisations.

Establishing trust at this individual level is critical to reducing risk and establishing digital trust is key to streamlining workflows in financial services, like onboarding, trade finance, and anti-financial crime.

This is where Verifiable Legal Entity Identifiers (vLEIs) come into the picture.

What is the new vLEI initiative and how will it be used?

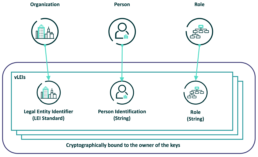

Put simply, vLEIs combine the organisation’s identity (the existing LEI), a person, and the role they play in the organisation into a cryptographically-signed package.

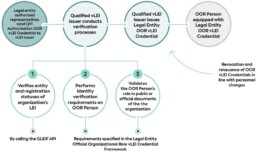

GLEIF has been working to create a fully digitised LEI service enabling instant and automated identity verification between counterparties across the globe. This drive for instant automation has been made possible by developments in blockchain technology, self-sovereign identity (SSI) and other decentralised key management platforms (Introducing the verifiable LEI (vLEI), GLEIF website).

vLEIs are secure digitally-signed credentials and a counterpart of the LEI, which is a unique 20-digit alphanumeric ISO-standardised code used to represent a single legal organisation. The vLEI cryptographically encompasses three key elements; the LEI code, the person identification string, and the role string, to form a digital credential of a vLEI. The GLEIF database and repository provides a breakdown of key information on each registered legal entity, from the registered location, the legal entity name, as well as any other key information pertaining to the registered entity or its subsidiaries, as GLEIF states this is of “principally ‘who is who’ and ‘who owns whom’”(GLEIF eBook: The vLEI: Introducing Digital I.D. for Legal Entities Everywhere, GLEIF Website).

In December 2022, GLEIF launched their first vLEI services through proof-of-concept (POC) trials, offering instant digitally verifiable credentials containing the LEI. This is to meet GLEIF’s goal to create a standardised, digitised service capable of enabling instant, automated trust between legal entities and their authorised representatives, and the counterparty legal entities and representatives with which they interact” (GLEIF eBook: The vLEI: Introducing Digital I.D. for Legal Entities Everywhere, page 2).